8 Essential Interview Questions for CFO Roles in 2025

Hiring Your Next Financial Leader: A Guide to Insightful CFO Interview Questions

In the high-stakes world of business growth, the Chief Financial Officer is more than just a numbers expert; they are a strategic partner, a risk manager, and a core driver of value. Hiring the right CFO can be the difference between sustainable scaling and a cautionary tale. The key to identifying an exceptional candidate lies in asking the right questions, those that probe beyond technical accounting to reveal strategic acumen, leadership under pressure, and foresight.

This guide provides a curated list of essential interview questions for a CFO, designed to uncover the depth of their experience and their fit for your organization. For each question, we break down what makes it critical, what to look for in a strong answer, and how to assess a candidate’s true capabilities. Whether you’re a founder, CEO, or part of a hiring committee, these insights will equip you to move past surface-level discussions and evaluate the financial leadership necessary to navigate complex challenges. You will learn to identify a candidate who not only manages finances but also helps shape the future of your company.

1. Walk me through a cash flow statement and how you would improve cash flow

This foundational question is a staple in interviews for a reason. It serves a dual purpose: first, it tests your core technical accounting knowledge, and second, it reveals your strategic mindset for improving a company’s financial health. A strong candidate won’t just define the components; they will connect them to actionable business strategies. This is one of the most revealing interview questions for a CFO because it separates theoretical knowledge from practical, impactful leadership.

A top-tier answer moves beyond a simple textbook definition. It demonstrates a holistic understanding of how cash moves through an organization and how a CFO can influence its velocity and availability.

How to Structure Your Answer

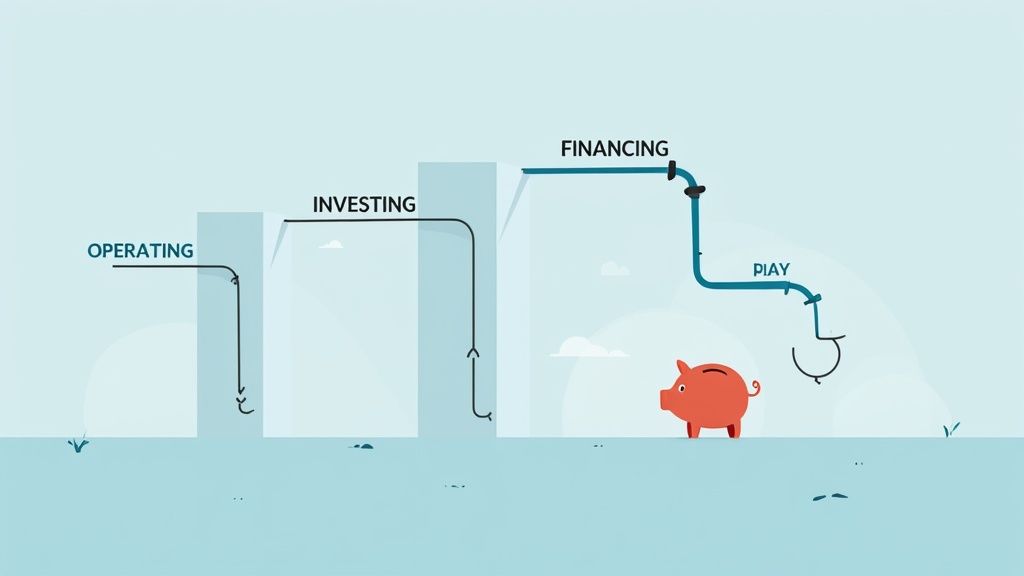

Start by clearly and concisely breaking down the three sections of the cash flow statement:

- Cash Flow from Operating Activities (CFO): Explain that this reflects the cash generated from a company’s principal revenue-producing activities. Mention key adjustments like depreciation and changes in working capital (e.g., accounts receivable, accounts payable, inventory).

- Cash Flow from Investing Activities (CFI): Describe this as cash used for or generated from the acquisition and disposal of long-term assets and other investments. This includes capital expenditures (CapEx) and acquisitions.

- Cash Flow from Financing Activities (CFF): Detail this as the cash flow between a company and its owners and creditors. This covers activities like issuing debt, repaying debt, issuing stock, and paying dividends.

Transitioning to Strategic Improvements

After defining the components, pivot to specific, quantifiable strategies for improvement. A great response connects a tactical change directly to a strategic outcome. For example, instead of just saying “improve collections,” provide a concrete example: “In my last role, I led a cross-functional initiative with Sales and Operations to reduce our Days Sales Outstanding (DSO). By refining contract terms and implementing an automated invoicing system, we successfully lowered DSO from 45 to 30 days, which unlocked $5 million in working capital and improved our cash conversion cycle.”

Other powerful examples include discussing how renegotiating supplier payment terms from net-30 to net-60 improved operating cash flow or how implementing a just-in-time inventory system reduced holding costs and freed up capital tied up in stock. Mentioning the use of technology, like cash forecasting tools, also demonstrates a modern, data-driven approach.

2. How would you approach a potential acquisition or merger from a financial perspective

This question goes beyond simple valuation; it probes your ability to act as a strategic partner to the CEO and the board. Your answer should demonstrate a comprehensive understanding of the entire M&A lifecycle, from initial strategic alignment to post-merger integration. It’s one of the most critical interview questions for a CFO because it assesses your capacity to steward a company through a high-stakes, transformative event, balancing aggressive growth targets with prudent risk management.

A superior response will frame the M&A process as a disciplined, multi-stage project, highlighting your role in ensuring the deal creates long-term shareholder value rather than just short-term headlines. This requires blending deep technical expertise with strategic foresight.

How to Structure Your Answer

Begin by outlining the key phases of your M&A approach, demonstrating a structured and methodical mindset.

- Strategic Alignment and Target Screening: Explain that the first step is ensuring any potential deal aligns with the company’s overall strategic growth plan. This involves defining clear acquisition criteria (e.g., market position, technology, customer base) before even starting the search.

- Valuation and Due Diligence: Detail your approach to valuation, mentioning specific methodologies like Discounted Cash Flow (DCF), comparable company analysis (comps), and precedent transactions. Emphasize that due diligence goes beyond financials to include operational, legal, and cultural assessments to uncover hidden liabilities and integration risks.

- Deal Structuring and Negotiation: Discuss how you would structure the deal (e.g., cash, stock, earn-outs) to optimize financial outcomes and mitigate risks. Mention your role in negotiating key terms to protect the company’s interests.

- Integration Planning and Execution: Describe the critical importance of post-merger integration. Explain that a detailed integration plan, developed early in the process, is essential for realizing projected synergies and ensuring a smooth transition.

Transitioning to Strategic Examples

After outlining your framework, provide concrete examples that showcase your experience and impact. For instance, you could say, “During the acquisition of a SaaS company, my due diligence team identified potential revenue churn that wasn’t immediately obvious. We structured a deal with an earn-out provision tied to customer retention, which protected our investment and incentivized the acquired management team. This approach was crucial in achieving our 15% IRR target post-acquisition.”

Other strong examples include discussing how you identified and quantified specific cost synergies, such as consolidating back-office functions or procurement, leading to a specific dollar amount in savings. Mentioning how you modeled various economic scenarios to stress-test the deal’s viability also demonstrates a sophisticated, forward-looking approach to risk management. Highlighting your experience in both financial and cultural integration shows you understand the full scope of what makes a merger successful.

3. Describe a time when you had to present bad news to the board or CEO

This behavioral question is designed to test a candidate’s leadership, emotional intelligence, and communication skills under immense pressure. The CFO is not just a numbers expert; they are a key strategic partner who must navigate difficult conversations with poise and transparency. The ability to deliver bad news effectively, while maintaining trust and presenting a clear path forward, is a hallmark of an exceptional financial leader. This is one of the more telling interview questions for a CFO, as it reveals how you handle accountability and crisis.

A strong answer will go beyond simply stating the problem. It will demonstrate a proactive, solution-oriented approach that instills confidence in stakeholders, even when the news itself is negative. It showcases your ability to own the situation and guide the organization through turbulence.

How to Structure Your Answer

Frame your response using the STAR method (Situation, Task, Action, Result) to provide a clear and compelling narrative.

- Situation: Briefly set the scene. What was the bad news? For instance, you discovered a significant revenue shortfall against the forecast, a material weakness in internal controls, or a looming cash flow crisis that required emergency action.

- Task: Define your specific responsibility. Your task was not just to report the numbers but to analyze the root cause, quantify the impact, and develop a credible recovery plan to present to the CEO and board.

- Action: Detail the steps you took. This is where you demonstrate leadership. Explain how you communicated with no surprises, presented the data with full transparency, and came prepared with solutions. Did you propose a cost-reduction plan, a strategy to secure bridge financing, or a revised forecast with clear assumptions?

- Result: Conclude by explaining the outcome of your actions. This should highlight how you stabilized the situation, regained stakeholder confidence, and implemented process improvements to prevent a recurrence. For instance, “By presenting a clear remediation plan alongside the bad news, we secured the board’s support for a new forecasting model, which improved accuracy by 15% in the following two quarters.”

Transitioning to Strategic Improvements

Your answer should emphasize that delivering bad news is also an opportunity to build trust and drive positive change. Discuss the importance of transparency, accountability, and proactive problem-solving. A great candidate will also reflect on the lessons learned from the experience. Showing how you used a difficult situation to strengthen internal controls, refine forecasting processes, or improve cross-departmental communication demonstrates strategic thinking. These are the executive communication skills that separate a good CFO from a great one.

4. How do you evaluate and manage financial risk in the organization

This question probes beyond your technical skills to assess your strategic foresight and ability to protect the company’s value. Interviewers want to see that you can identify, quantify, and mitigate a wide spectrum of financial risks, from market volatility to operational failures. A compelling answer demonstrates a structured approach to enterprise risk management (ERM) and shows how a proactive risk strategy can be a competitive advantage, not just a defensive measure. This is a critical one of the interview questions for a CFO, as it reveals your capacity to balance growth ambitions with prudent financial stewardship.

A top-tier candidate will articulate a comprehensive framework, showing they can move from high-level policy to tactical execution. They will connect risk management directly to the company’s strategic objectives, demonstrating its value in decision-making and capital allocation.

How to Structure Your Answer

Begin by outlining a clear, systematic process for risk management, often based on a recognized framework like COSO. This shows you have a formal and repeatable methodology.

- Risk Identification: Explain how you identify risks across different categories. This includes market risk (interest rate, currency), credit risk (customer defaults), liquidity risk (cash flow shortfalls), and operational risk (internal process failures, fraud).

- Risk Assessment & Quantification: Describe how you would measure the potential impact and likelihood of these identified risks. Mention both quantitative methods (e.g., Value at Risk, sensitivity analysis) and qualitative assessments for risks that are harder to model.

- Risk Mitigation & Response: Detail the strategies you would use to manage the risks. These can include avoiding the risk, transferring it (e.g., through insurance or hedging), reducing it via internal controls, or accepting it if it falls within the company’s established risk appetite.

Transitioning to Strategic Application

After outlining your framework, provide concrete examples of how you have applied it. A powerful response links a specific risk to a specific action and a measurable result. For instance: “At my previous company, we had significant exposure to foreign exchange fluctuations on €100M of annual revenue. I implemented a hedging program using forward contracts that stabilized our gross margin and reduced earnings volatility by 15%.”

Other strong examples could involve creating an enterprise risk dashboard for board reporting, developing a credit risk model that cut bad debt by 30%, or establishing vendor concentration limits after a supply chain disruption highlighted a critical vulnerability. Discussing how you foster a strong risk culture through training and clear communication shows leadership. For a deeper dive into this topic, you can learn more about robust risk management strategies to see how these concepts are applied.

5. What key performance indicators (KPIs) would you track and report to stakeholders

This question probes a candidate’s ability to distill complex business operations into a concise set of meaningful metrics. It assesses their strategic acumen in selecting the right KPIs for different audiences, from the board of directors to operational teams. A superior answer demonstrates an understanding that KPIs are not just for reporting; they are tools for driving behavior, making decisions, and aligning the entire organization around strategic goals. This is one of the more telling interview questions for a CFO as it reveals if they can translate financial data into a compelling narrative about business performance and future direction.

A candidate who excels will move beyond generic metrics like revenue and profit. They will showcase a nuanced, industry-specific approach, proving they can identify the true drivers of value for that particular business model.

How to Structure Your Answer

Begin by acknowledging that KPIs are not one-size-fits-all and must be tailored to the business model, industry, and specific audience. Then, segment your answer by stakeholder group to show sophisticated communication skills:

- For the Board/Investors: Focus on high-level, strategic indicators that reflect shareholder value. Mention metrics like Earnings Per Share (EPS), Return on Invested Capital (ROIC), Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio, and Free Cash Flow.

- For the Executive Team: Discuss operational and financial metrics that drive day-to-day decisions. This includes metrics like Monthly Recurring Revenue (MRR) for a SaaS company, Gross Margin by product line, Days Sales Outstanding (DSO), and EBITDA margins.

- For Department Heads: Explain how you would provide more granular, functional KPIs. For a sales leader, this could be sales cycle length or quota attainment. For a marketing leader, it might be cost per lead or marketing-originated customer percentage.

Transitioning to Strategic Implementation

After outlining the “what,” pivot to the “how.” A strong response details the process of implementing and using these KPIs. For example, describe how you would use a dashboarding tool like Tableau or Power BI to provide real-time visibility. A powerful example would be: “In my previous role, we were struggling with margin erosion. I built a real-time gross margin report by product SKU, which allowed the sales and product teams to see the direct profitability impact of discounting. This data-driven insight led to a revised pricing strategy that increased overall gross margin by 3% within two quarters.”

Mentioning the importance of balancing leading indicators (like sales pipeline growth) with lagging indicators (like quarterly revenue) also demonstrates foresight. Emphasize that the ultimate goal of tracking KPIs is not just reporting but to spark conversation, identify root causes, and drive corrective actions that improve performance.

6. How would you handle a situation where actual results significantly differ from budget

This question moves beyond simple financial reporting to test a candidate’s crisis management, analytical rigor, and communication skills. It’s designed to see how a potential CFO reacts under pressure and shifts from a monitoring role to a proactive, problem-solving one. The interviewer wants to understand your process for diagnosing the root cause of a variance and your ability to steer the company back on course. Answering this effectively is crucial, as it showcases your leadership and strategic value far more than just managing numbers.

This is one of the most practical interview questions for a CFO because it simulates a real-world scenario that every finance leader inevitably faces. A great answer demonstrates a systematic, calm, and collaborative approach to a high-stakes problem, proving you can manage both the financials and the associated stakeholder expectations.

How to Structure Your Answer

Begin by outlining a clear, logical process for addressing the variance. Avoid jumping straight to solutions; instead, emphasize a methodical investigation first.

- Immediate Triage & Validation: Explain that your first step is to confirm the data’s accuracy. Was it a reporting error, a timing issue, or a genuine performance deviation?

- Root Cause Analysis: Describe how you would dig deeper. This involves more than just looking at the P&L; it requires collaborating with department heads. For example, if revenue is down, you’d work with the sales team to understand if it’s a pipeline issue, a competitive threat, or a product launch delay.

- Quantify the Impact: Detail your process for re-forecasting the rest of the year based on this new information to understand the full financial impact on profitability, cash flow, and covenants.

- Develop Corrective Actions: Explain that solutions should be two-fold: immediate actions to mitigate the current-year impact (e.g., a hiring freeze, marketing spend reduction) and long-term strategic adjustments to prevent recurrence (e.g., improving sales forecasting models, diversifying customer base).

Transitioning to Strategic Improvements

Connect your tactical response to a broader strategic narrative. A superior candidate shows how they use these challenges as learning opportunities to make the business more resilient. For instance, you could say, “In a previous role, a major customer unexpectedly went bankrupt, causing a significant revenue shortfall. After managing the immediate cash flow impact, I led a project to implement a customer concentration risk model. This new framework set exposure limits and triggered proactive engagement with at-risk accounts, which became a permanent part of our risk management process.”

Mentioning how you would manage communication is also critical. Discuss how you would transparently update the CEO, the board, and investors, presenting not just the problem but a clear, actionable plan. This demonstrates accountability and leadership, core traits of an effective CFO.

7. What is your approach to capital allocation and investment decisions?

This strategic question moves beyond day-to-day finance and into the core of long-term value creation. An interviewer asks this to gauge your ability to think like an owner, deploying the company’s limited capital in a way that generates the highest possible return. Your response should demonstrate a disciplined, analytical, and forward-looking framework for making these critical choices. It’s one of the most important interview questions for a CFO because it shows how you balance risk, growth, and shareholder returns.

A truly exceptional answer will blend financial theory with practical business acumen. It shows you can weigh competing priorities, such as investing in new technology, acquiring a competitor, paying down debt, or returning capital to shareholders, and make a decision that aligns with the company’s overarching strategy.

How to Structure Your Answer

Begin by outlining your philosophical approach, explaining that capital allocation is a rigorous process designed to maximize shareholder value. Then, detail the specific criteria and methodologies you use.

- Establish a Framework: Explain that you start by aligning all investment decisions with the company’s strategic plan. This involves creating a disciplined capital budgeting process that all business units must follow.

- Define Evaluation Criteria: Discuss the quantitative metrics you rely on. Mention standard methods like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period, but also explain how you apply them. For instance, you could mention establishing different hurdle rates for different projects based on their risk profiles.

- Incorporate Risk Assessment: Detail how you analyze and quantify risk. A strong answer will go beyond the numbers and discuss evaluating market risk, execution risk, and how a potential investment fits into the company’s overall risk portfolio.

Transitioning to Strategic Improvements

Connect your framework to tangible business outcomes. A powerful response uses specific examples to illustrate your impact. For instance, you could say, “In my previous role, I developed a new capital allocation framework that prioritized projects based on risk-adjusted IRR and strategic fit. This led us to divest a non-core, low-return division and reinvest the proceeds into our high-growth SaaS product line, ultimately increasing our company-wide ROIC from 12% to 18% over two years.”

Other compelling examples include explaining how you balanced organic growth investments against potential M&A opportunities by performing a rigorous build-versus-buy analysis. Discussing how you’ve championed investments in technology or infrastructure that didn’t have a direct, immediate ROI but were critical for long-term scalability also demonstrates strategic foresight. This proves you can make tough decisions that create sustainable value.

8. How do you stay current with accounting standards and regulatory changes

This question is designed to gauge your proactivity, attention to detail, and commitment to lifelong learning. In a world of constantly evolving regulations like ASC 606 and 842, a CFO cannot afford to be reactive. Your answer should demonstrate a systematic process for staying informed and, more importantly, for translating that knowledge into compliant, forward-thinking business practices. This is one of the most critical interview questions for a CFO as it directly speaks to your ability to mitigate risk and protect the company.

A strong candidate will move beyond simply stating they read publications. They will detail the systems they put in place to ensure the entire finance function remains ahead of the curve, connecting compliance directly to strategic risk management and operational readiness.

How to Structure Your Answer

Begin by outlining your multi-pronged approach to staying informed. Show that you don’t rely on a single source but rather a network of information channels.

- Professional Affiliations and Education: Mention your active memberships in organizations like the AICPA or Financial Executives International (FEI). Discuss your commitment to CPE (Continuing Professional Education), highlighting specific courses or certifications relevant to recent changes.

- Industry and Firm Resources: Reference your use of resources from Big Four accounting firms (PwC, Deloitte, EY, KPMG), which provide extensive thought leadership, webcasts, and summaries of new pronouncements.

- Internal Processes: Explain how you disseminate this information. This is crucial as it shows your leadership. Describe how you establish a formal process, such as a quarterly accounting standards update meeting, to educate your finance and accounting teams.

Transitioning to Strategic Implementation

After detailing your methods for staying current, pivot to demonstrating how you apply this knowledge strategically. A powerful answer will provide concrete examples of how you have led a company through a significant regulatory change. For instance, you could say, “In my previous role, I led our adoption of ASC 842 for lease accounting. I initiated the project 18 months ahead of the deadline, forming a cross-functional team to inventory all leases and select an appropriate software solution. This proactive approach ensured we were compliant without last-minute scrambling and allowed us to leverage the data for better lease-versus-buy decisions.”

Other effective examples include discussing your involvement in commenting on proposed FASB standards to advocate for your industry’s position or how you balance the cost of compliance with the business benefits. This shows you are not just a rule-follower but a strategic leader who manages compliance as an integral part of the business strategy.

Key CFO Interview Questions Comparison

| Topic | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Walk me through a cash flow statement and how you would improve cash flow | Moderate – Requires clear explanation of cash flow components and optimization strategies | Moderate – Needs data access and collaboration | Improved cash management and working capital optimization | CFO interviews assessing technical and strategic cash management | Directly tests core CFO skills; communication clarity |

| How would you approach a potential acquisition or merger from a financial perspective | High – Complex due diligence, valuation, integration planning | High – Involves cross-functional teams and extensive data | Successful M&A execution, risk mitigation, growth initiatives | Growth-oriented companies evaluating M&A capabilities | Tests multiple CFO competencies; real deal experience |

| Describe a time when you had to present bad news to the board or CEO | Moderate – Requires storytelling and behavioral insight | Low – Based on personal experience | Demonstrates leadership, communication, and crisis management | Behavioral interviews focused on leadership and emotional intelligence | Reveals true leadership character and credibility |

| How do you evaluate and manage financial risk in the organization | High – Involves risk frameworks, modeling, controls | Moderate to High – Depends on systems and data | Balanced risk-taking and regulatory compliance | CFO roles with fiduciary responsibility and regulatory focus | Combines technical and strategic risk management |

| What key performance indicators (KPIs) would you track and report to stakeholders | Moderate – Needs understanding of metrics and reporting | Moderate – Access to data and reporting tools | Effective performance management and stakeholder communication | Performance management and strategic decision making | Shows strategic metric selection and communication |

| How would you handle a situation where actual results significantly differ from budget | Moderate – Requires analytical and communication skills | Low to Moderate – Relies on forecasting and reporting | Timely corrective actions and improved forecasting accuracy | CFO interviews assessing variance analysis and problem solving | Tests accountability and solution-oriented thinking |

| What is your approach to capital allocation and investment decisions | High – Strategic evaluation and prioritization required | Moderate – Requires financial analysis resources | Maximized shareholder value through optimal investments | Strategic CFO roles focusing on long-term value creation | Combines technical skills with long-term strategy |

| How do you stay current with accounting standards and regulatory changes | Low to Moderate – Ongoing learning and process updates | Low – Relies on professional development | Compliance, updated standards application, risk minimization | CFO roles requiring regulatory compliance and standards adherence | Demonstrates professional commitment and compliance |

From Questions to Confidence: Securing Your Next CFO

The journey to hiring a Chief Financial Officer is one of the most critical undertakings for any leadership team. The extensive list of interview questions for CFO candidates provided in this guide is more than a simple script. It is a strategic toolkit designed to help you peel back the layers of a resume and truly understand the person who will steward your company’s financial future. From navigating cash flow challenges and evaluating M&A opportunities to communicating difficult news with poise, these questions are crafted to reveal not just what a candidate knows, but how they think, lead, and execute under pressure.

A successful interview process moves beyond rote answers. The strongest candidates will demonstrate a clear throughline connecting their past experiences to your company’s specific challenges and future ambitions. They won’t just define a KPI; they will explain why it’s the right metric for your business model and how they would use it to drive strategic decisions. This ability to bridge the gap between financial data and business growth is the hallmark of an exceptional CFO.

Key Takeaways for Your Hiring Process

To maximize the effectiveness of your interviews, keep these core principles at the forefront:

- Prioritize Strategic Insight Over Technical Recitation: While knowledge of accounting standards is essential, a great CFO is a strategic partner. Focus on how candidates translate financial information into actionable business strategy, such as their approach to capital allocation or risk management in the context of your industry.

- Probe for Real-World Examples: Hypothetical answers are easy. Insist on concrete examples. Asking “Describe a time when…” forces candidates to draw from actual experience, revealing their problem-solving skills, leadership style, and ability to handle adversity.

- Evaluate Cultural and Leadership Fit: A CFO must inspire confidence and collaborate effectively with the board, CEO, and other departments. Questions about presenting bad news or handling budget variances are excellent windows into their communication skills and leadership temperament.

Actionable Next Steps to Secure Your Ideal CFO

Transforming these insights into a successful hire requires a structured approach. First, customize this list of questions to align with your company’s immediate priorities, whether that’s fundraising, improving profitability, or preparing for an exit. Second, assemble an interview panel that includes the CEO, board members, and other key executives to gain a holistic view of each candidate. Finally, remember that the interview is a two-way street; be prepared to articulate your vision and explain why your company is a compelling opportunity for a top-tier financial leader.

Ultimately, mastering the art of the CFO interview is about building confidence, both in your chosen candidate and in your company’s financial trajectory. It’s an investment of time and effort that pays dividends in sound financial stewardship, strategic growth, and long-term stability.

Finding this elite level of talent can be a significant hurdle, especially for startups and growing businesses. If you need executive-level financial strategy without the commitment of a full-time hire, Shiny’s marketplace is your solution. Connect with our vetted, world-class fractional CFOs today and build the financial leadership your business needs to thrive. Explore top-tier financial talent on Shiny.