Understanding Chief Revenue Officer Responsibilities

The core job of a Chief Revenue Officer (CRO) is to align every revenue-generating team—sales, marketing, and customer success—to pull in the same direction. A CRO's mission isn't just managing departments; it's to build a single, powerful revenue engine that drives predictable growth across the entire customer lifecycle.

Many businesses hit a wall where departmental friction stalls growth. Sales complains about lead quality, marketing feels their efforts are wasted, and customer success is left dealing with unhappy clients. This isn't just an internal headache; it's a direct drag on your bottom line.

A CRO is the strategic leader who dismantles these silos and architects a unified go-to-market strategy.

What a Chief Revenue Officer Actually Does

The title "Chief Revenue Officer" sounds straightforward, but the role’s impact goes far beyond simply hitting sales numbers.

Imagine your business is a high-performance race car. The sales team is the powerful engine. Marketing is the sleek, aerodynamic body that cuts through the noise. Customer success is the elite pit crew, ensuring the car stays on the track and performs at its peak. Each part can be world-class, but without an chief engineer aligning them, you're not winning the race.

The CRO is that chief engineer. They are obsessed with building a machine for predictable, sustainable growth. This holistic view is what makes the CRO role so critical for any company serious about scaling.

Moving Beyond Departmental Silos

One of the biggest hurdles for growing companies is the silo problem. Sales gripes about poor leads from marketing. Marketing feels sales isn't closing the deals they generate. Customer success is caught in the middle, trying to retain customers who were promised one thing and sold another.

This internal tug-of-war is expensive. Misalignment between sales and marketing alone can cause revenues to shrink by 10% or more annually. The CRO’s primary responsibility is to demolish those walls.

A CRO architects a seamless customer journey. Every touchpoint—from the first ad a prospect sees to their renewal call—should feel like one consistent, valuable conversation.

The Conductor of the Revenue Orchestra

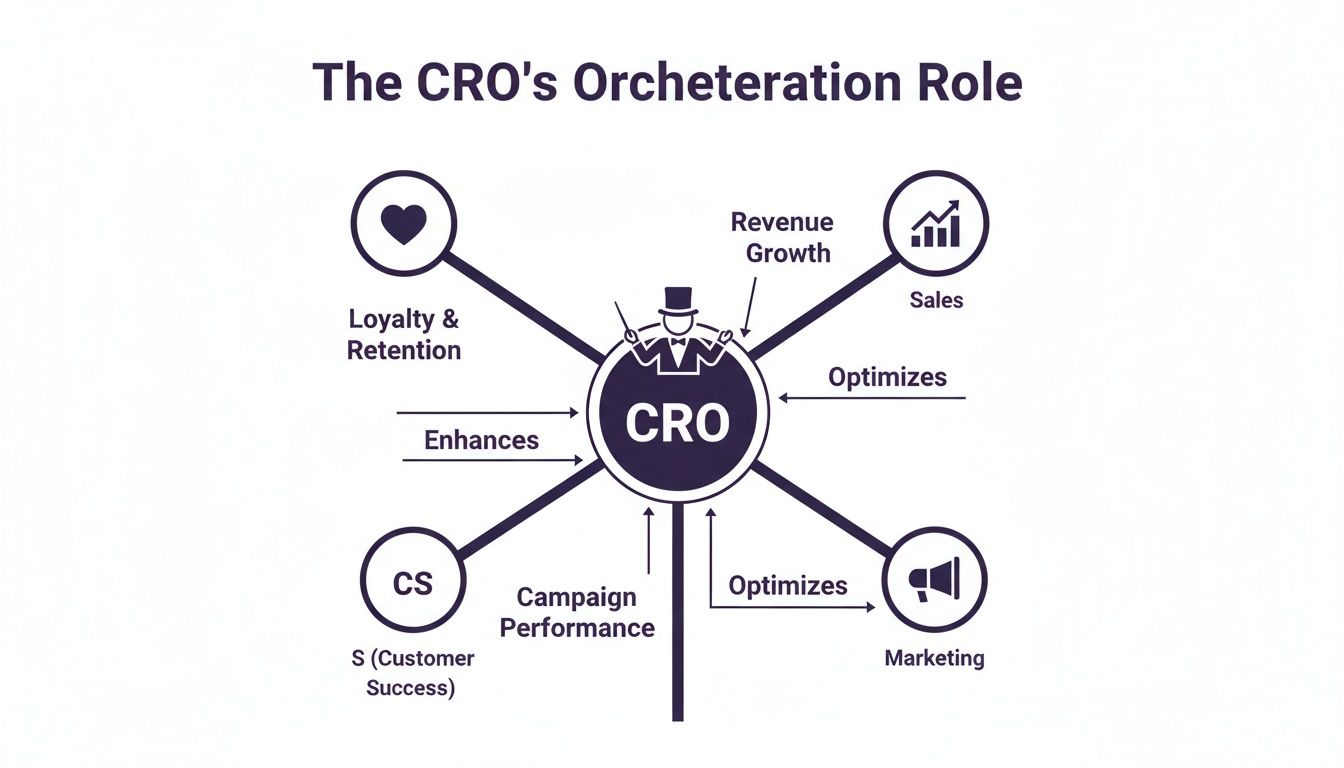

Here’s another analogy: think of an orchestra. Sales might be the bold brass section, marketing the captivating strings, and customer success the steady percussion. Each section is talented, but without a conductor, you just get noise.

The CRO is that conductor. They ensure everyone plays from the same sheet music, creating a powerful, unified sound. This means they are responsible for:

- Forging a Unified Strategy: A CRO sets shared KPIs that matter to the whole business, like Customer Lifetime Value (LTV) and Net Revenue Retention (NRR).

- Integrating Tech and Processes: They champion "revenue operations" (RevOps), ensuring the company's tech stack creates a frictionless path for the customer.

- Building a Culture of Accountability: The CRO ensures every team understands how their work contributes to the bigger revenue picture.

This is a stark contrast to a traditional structure where a VP of Sales is solely focused on hitting a sales quota.

CRO vs VP of Sales At a Glance

The table below highlights the CRO’s broader, more strategic view compared to a traditional sales leader.

| Area of Focus | VP of Sales | Chief Revenue Officer (CRO) |

|---|---|---|

| Primary Goal | Meeting quarterly sales quotas and targets. | Driving long-term, predictable, and sustainable revenue growth. |

| Scope | Manages the sales team and sales process exclusively. | Oversees all revenue-generating departments: sales, marketing, and customer success. |

| Metrics | New bookings, win rates, and sales pipeline velocity. | Customer Lifetime Value (LTV), Net Revenue Retention (NRR), and Customer Acquisition Cost (CAC). |

| Time Horizon | Short-term (monthly and quarterly performance). | Long-term (1-3 year strategic growth and market expansion). |

| Customer Focus | Primarily on acquiring new customers (the "hunt"). | The entire customer lifecycle, from acquisition to retention and expansion. |

| Alignment | Focuses on sales team alignment and performance. | Focuses on cross-functional alignment across the entire revenue engine. |

A CRO isn’t just a supercharged VP of Sales; they are a strategic leader tasked with building a cohesive system for growth.

By connecting these once-separate departments, a CRO transforms internal friction into a powerful revenue machine. For businesses that feel stuck, hiring a strategic leader to unify these efforts is often the key to unlocking the next level of growth. Exploring fractional leadership offers a smart way to get this expertise without the full-time executive cost.

Aligning Teams into a Single Revenue Engine

A Chief Revenue Officer’s most critical responsibility is strategic alignment. They are the organizational glue, breaking down the walls between sales, marketing, and customer success.

Without this leadership, companies get stuck in a frustrating loop. Marketing generates leads that sales can’t close, and customer success deals with the unhappy customers who slip through. It's an inefficient and expensive cycle.

A CRO’s mission is to transform these disconnected departments into a cohesive revenue engine. This involves architecting a shared system of goals, processes, and accountability that covers the entire customer journey.

This visual shows how the CRO acts as a central conductor, ensuring every team plays in harmony.

The CRO's influence touches every go-to-market function to create a customer experience that’s not just seamless, but profitable.

Building a Foundation on Shared Metrics

The first step in breaking down silos is establishing a shared scorecard. A CRO shifts the focus from department-specific metrics (like lead volume) to shared KPIs that drive the business forward.

Suddenly, everyone is accountable for outcomes that truly matter, like:

- Lifetime Value (LTV): This forces marketing to find better customers, pushes sales to close good-fit deals, and places customer success at the heart of profitability.

- Net Revenue Retention (NRR): When NRR is a shared goal, sales is motivated to set correct expectations, and marketing creates content that helps existing customers succeed, paving the way for upsells.

By rallying everyone around unified metrics, the CRO changes the internal conversation from "my team's numbers" to "our company's revenue."

A CRO's ultimate goal is to make revenue generation a team sport. When sales, marketing, and customer success all have skin in the game for metrics like NRR, the internal finger-pointing stops and genuine collaboration begins.

Creating Practical Alignment with SLAs

To turn shared goals into reality, a CRO implements a practical framework like a Service Level Agreement (SLA). An SLA is a formal agreement defining the commitments between teams.

For instance, an SLA might define a "Marketing Qualified Lead" (MQL) and commit the sales team to follow up within a specific timeframe. This simple document cuts through ambiguity and creates clear accountability.

Real-World Example: A SaaS company was struggling with high churn, and the sales team constantly complained about bad leads. Marketing was rewarded for lead quantity, while sales needed quality. A fractional CRO identified the misalignment.

The solution was simple but powerful:

- Implement an SLA: Marketing agreed to deliver fewer, more qualified leads. In return, sales committed to a 24-hour follow-up on every qualified lead.

- Create a Feedback Loop: The customer success team shared churn reasons directly with sales and marketing weekly, which was used to refine targeting and qualification.

Within two quarters, pipeline velocity increased and churn dropped by 15%. This is a perfect illustration of how effective cross-functional team management directly impacts the bottom line.

Ultimately, the CRO’s job is to build a system where every team contributes to the entire revenue lifecycle. By aligning goals, processes, and people, they create a predictable growth machine.

Building the Long-Term Revenue Roadmap

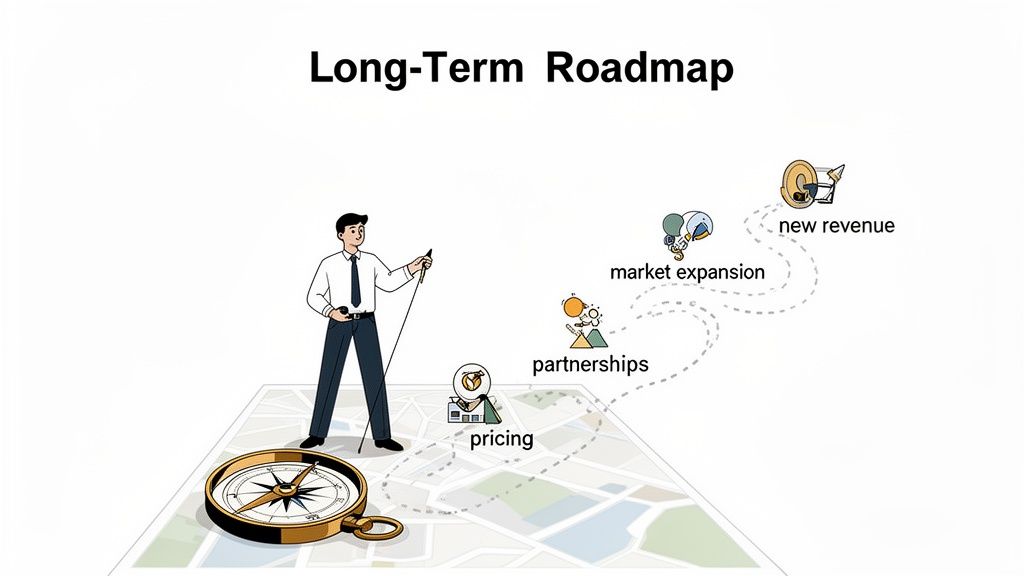

While aligning internal teams is a critical day-to-day function, a Chief Revenue Officer's real value lies in their ability to see over the horizon. They are the architect of the company's long-term, sustainable growth.

This strategic foresight separates a good CRO from a great one. Think of them as the chief navigator for your business, charting a course through a competitive ocean, anticipating future storms, and spotting profitable new islands to explore.

This long-range planning involves digging into market trends, finding new monetization opportunities, and building scalable go-to-market strategies.

Uncovering New Revenue Streams

A great CRO is always asking, "What else can we offer our customers?" They look beyond the core product to find untapped potential. This could mean experimenting with new pricing models, bundling services, or launching new product tiers.

This isn't guesswork; it's a data-driven process. By analyzing customer behavior and market demand, a CRO can pinpoint adjacent opportunities, such as:

- Pricing and Packaging Optimization: Reworking pricing tiers to better match the value different customer segments receive.

- New Market Expansion: Validating new regions or industries where the company’s solution solves a burning problem.

- Strategic Partnerships: Teaming up with complementary businesses to tap into their customer base or create a stronger joint offering.

This thinking prevents a company from being a one-trick pony and builds resilience through multiple paths to growth.

A CRO's strategic roadmap isn't a static document; it's a living plan that adapts to market shifts. Their job is to ensure the company is always skating to where the puck is going, not where it's been.

Case Study: A Fractional CRO Unlocks Hidden Value

Take a $5M manufacturing firm with flat revenue. They brought in a fractional CRO to find new growth opportunities without the high cost of a full-time executive.

The fractional CRO quickly noticed that customers were constantly calling for technical support and installation advice—a service the company gave away for free. After analyzing support logs and interviewing key customers, the CRO spotted a huge opportunity.

The solution? They launched a premium service tier offering on-site installation, training, and ongoing maintenance contracts. This created a new, high-margin, recurring revenue stream from their existing customer base. Within a year, this service model accounted for 20% of their new revenue.

This is a perfect example of how an experienced executive can bring an objective, strategic eye to uncover value hiding in plain sight.

Scaling the Go-to-Market Strategy

Finally, a CRO is responsible for ensuring the go-to-market (GTM) strategy is built to scale. A plan that works at $1M will break at $10M. The CRO constantly refines the GTM motion, ensuring that sales processes, marketing channels, and customer success playbooks can handle future growth.

By building a flexible and scalable roadmap, the CRO ensures that today's wins become the foundation for tomorrow's expansion, creating a truly predictable revenue machine.

Mastering the Metrics That Drive Growth

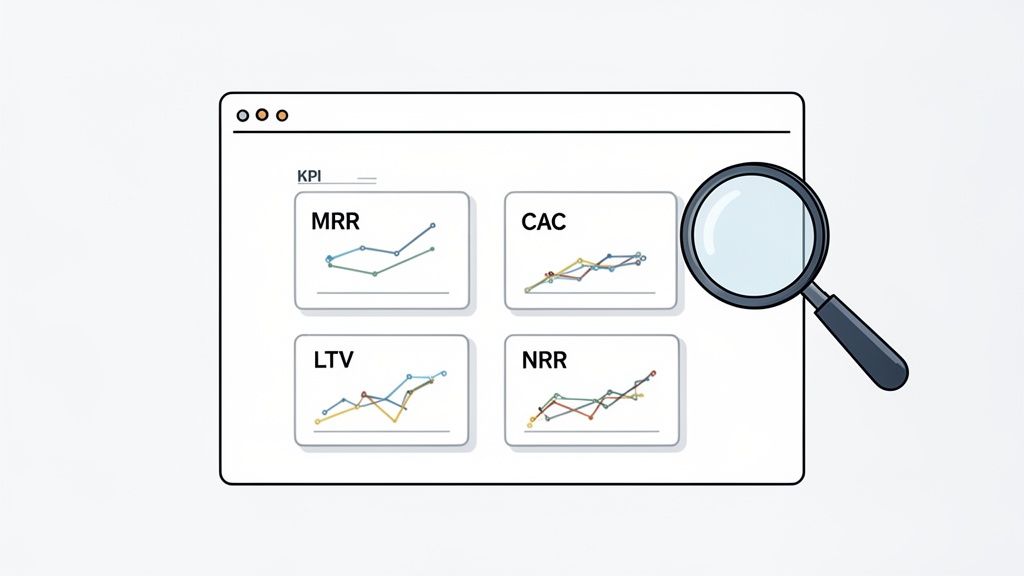

A great Chief Revenue Officer is obsessed with data, not guesswork. They live inside a dashboard of Key Performance Indicators (KPIs) that acts as the single source of truth for the entire business.

This isn't about vanity metrics. It's about getting a clear picture of the revenue engine's health and knowing which levers to pull to spark growth. The CRO ensures everyone—from marketing to sales to customer success—is aligned with the same data and chasing the same goals.

This unified view eliminates the blame game and builds a culture where everyone takes ownership of the numbers that matter.

How Revenue KPIs Tell a Story

Top-tier CROs know that revenue metrics are all connected. Their magic lies in seeing these cause-and-effect relationships and using them to build a predictable growth machine.

They focus on the essential trio of SaaS metrics:

- Monthly Recurring Revenue (MRR): The lifeblood of a subscription business. A CRO dissects this into new, expansion, and churned MRR to get a true read on momentum.

- Customer Acquisition Cost (CAC): Total sales and marketing spend divided by the number of new customers. The CRO’s job is to drive this down without stalling growth.

- Customer Lifetime Value (LTV): The total revenue you can expect from a single customer. It’s a powerful sign of long-term health.

For a healthy business, you need a strong LTV to CAC ratio—typically 3:1 or better. A CRO uses this ratio to make critical investment decisions.

A CRO views KPIs like a doctor views vital signs. A rising CAC might signal inefficient ad spend. A falling LTV could point to a product gap. Their job is to read the data, diagnose the problem, and prescribe the right fix.

Essential CRO Performance Metrics

| Metric | What It Measures | Why It's Critical for a CRO |

|---|---|---|

| Monthly Recurring Revenue (MRR) | The predictable, recurring revenue from all active subscriptions in a given month. | The ultimate pulse check for a subscription business. A CRO tracks its components (new, expansion, churn) to gauge growth velocity. |

| Customer Acquisition Cost (CAC) | The total cost of sales and marketing to acquire one new customer. | Measures the efficiency of the growth engine. A CRO's goal is to keep this low while scaling customer acquisition. |

| Customer Lifetime Value (LTV) | The total projected revenue a single customer will generate throughout their entire relationship with the company. | Indicates long-term profitability and customer loyalty. A healthy LTV:CAC ratio (ideally 3:1+) is a key sign of a sustainable business model. |

| Net Revenue Retention (NRR) | The percentage of recurring revenue retained from existing customers, including upsells, cross-sells, and downgrades/churn. | Anything over 100% means the business is growing from its existing customer base alone. It’s a powerful indicator of product stickiness. |

| Sales Cycle Length | The average time it takes to close a deal, from initial contact to a signed contract. | A shorter sales cycle means faster revenue recognition and a more efficient sales team. The CRO works to remove friction here. |

| Lead-to-Customer Conversion Rate | The percentage of leads that ultimately become paying customers. | This metric connects marketing efforts directly to sales outcomes, highlighting the quality of leads and the effectiveness of the sales process. |

Each of these numbers tells part of a larger story. The CRO's job is to connect the dots and use that story to guide the company forward.

Using Cohort Analysis to Find What Really Works

One of the most powerful tools in a CRO’s arsenal is cohort analysis. This involves grouping customers who signed up in the same period (e.g., the "January 2024 Cohort") and tracking their behavior over time.

This approach uncovers insights that get lost in company-wide averages.

For example, a CRO might notice that customers from the Q2 cohort—who experienced a new onboarding process—have a 20% higher Net Revenue Retention rate after six months. That's a huge signal that the new onboarding is working and should be rolled out immediately.

By using data to tie specific actions to revenue outcomes, a CRO makes smarter decisions. If your company struggles to connect actions to financial results, bringing in an expert to build this data infrastructure can be a game-changer.

The Essential Skills of a High-Impact CRO

A truly high-impact CRO is a rare breed—part strategic leader, part data scientist, and part master influencer. They don't just manage teams; they spark a unified movement toward sustainable revenue growth.

The role demands a unique mix of hard, technical skills and sophisticated soft skills. Think of a master chef: they need technical precision (hard skills) but also the creative vision to combine flavors and present a stunning dish (soft skills).

Foundational Hard Skills

A few non-negotiable skills form the bedrock of any effective CRO. These are the tangible abilities that allow them to architect and manage a revenue engine.

- Deep Financial Acumen: A CRO must speak the CFO's language, with a rock-solid grasp of financial models, P&L statements, and unit economics.

- Revenue Operations (RevOps) Mastery: A CRO must be an expert in optimizing processes, integrating the tech stack, and managing data to create a frictionless customer journey.

- Data Literacy and Forecasting: The ability to turn raw data into a compelling story is essential for building accurate revenue forecasts and holding teams accountable.

The Soft Skills That Separate Good from Great

While hard skills build the engine, soft skills are what make it run smoothly. A CRO's success hinges on their ability to influence people across the organization.

A CRO's influence is their most powerful asset. They often have to persuade other leaders to invest in long-term strategies over short-term wins, a task that requires immense credibility, trust, and political savvy.

Masterful negotiation isn’t just for closing enterprise deals. It’s used daily to secure a bigger budget, align on goals with the CMO, or convince the product team to prioritize a feature that will reduce churn.

These interpersonal skills are what allow a CRO to break down the organizational silos that kill growth. They build bridges, foster collaboration, and create a culture where everyone feels ownership over the company's success. Finding a leader with this balanced skill set is a huge challenge.

Getting CRO Expertise Without the Full-Time Cost

Let's be honest: the responsibilities of a Chief Revenue Officer are massive. It takes a rare mix of strategic vision, data acumen, and leadership to succeed. For most growing businesses, hiring a full-time executive with this skillset feels out of reach.

The high cost, long recruiting cycle, and potential for a mis-hire often leave founders feeling stuck—knowing they need strategic leadership but unable to justify the full-time price tag.

The Fractional Leadership Solution

Thankfully, there’s a much more practical way to bridge this gap: fractional leadership. A fractional CRO is a seasoned executive who joins your company on a part-time basis, typically for 10 to 20 hours a week. This model gives you access to elite talent for a fraction of the cost and commitment.

Think of it like hiring a world-class personal trainer for a few hours a week instead of putting them on your full-time payroll. You get all the expert guidance, customized plans, and accountability you need to hit your goals without the massive overhead.

Immediate Impact on a Part-Time Schedule

A fractional CRO zeroes in on high-impact strategic initiatives that deliver immediate value, rather than getting bogged down in day-to-day management.

Even with just a few hours a week, a fractional CRO can:

- Build a 90-Day Revenue Plan: Quickly diagnose your current revenue engine, pinpoint opportunities, and lay out an actionable roadmap for quick wins.

- Optimize Your Sales Process: Implement proven methodologies to remove friction and boost your team's efficiency.

- Align Your Go-to-Market Teams: Establish the shared metrics and SLAs needed to get sales, marketing, and customer success pulling in the same direction.

The true value of a fractional executive isn't measured in the hours they log, but in the strategic clarity they bring. Their experience lets them instantly pinpoint the critical leverage points in your business and focus their energy there for maximum impact.

This model de-risks the hiring process and provides an immediate return on investment. For businesses needing this level of guidance, understanding the fractional C-suite advantage is a strategic first step toward scalable growth.

If you're facing revenue challenges that demand seasoned leadership, exploring a fractional engagement can connect you with the right expert to build your revenue engine.

Got Questions About the CRO Role?

Even after laying out the core responsibilities, many founders still have practical questions about bringing on a Chief Revenue Officer. Let's tackle some of the most common ones.

When Should a Company Hire Its First CRO?

The right time to hire a CRO isn't about hitting a specific revenue number; it's about hitting a complexity ceiling.

This happens when the founder can no longer personally manage the friction between sales, marketing, and customer success. If you’re seeing symptoms like inconsistent sales forecasts, high customer churn, or a blame game between departments, you're probably there. These are all signs your revenue engine needs a dedicated architect.

How Is a CRO Different From a CMO or COO?

It's easy to see the overlap, but the focus is different. Imagine you're running a factory.

- The Chief Marketing Officer (CMO) creates demand for the factory's products.

- The Chief Operating Officer (COO) ensures the factory itself runs efficiently.

- The Chief Revenue Officer (CRO) owns the entire supply chain, from sourcing raw materials (leads) to delivering the final product and ensuring the customer is happy enough to return.

The CRO’s unique job is to own the entire financial journey of the customer and align all go-to-market teams to maximize its value.

A CRO’s success isn't defined by how well one department performs, but by holistic business outcomes like predictable revenue growth and customer lifetime value.

How Do You Measure a New CRO’s Success?

Look beyond top-line revenue, especially in the first six months. Instead, focus on leading indicators that show the revenue engine is getting healthier.

Track these key milestones:

- Process and Alignment Wins: Have they implemented an SLA between sales and marketing? Is there a single, unified dashboard with shared KPIs that everyone is using?

- Early Revenue Health Metrics: Are you seeing improvements in pipeline velocity or lead-to-customer conversion rates? Is the sales cycle shortening?

- Strategic Roadmap Development: Within the first few months, a great CRO should present a clear, data-backed 12-month revenue plan.

These early wins are proof that your CRO is building the foundation for long-term, predictable growth.

Navigating the complexities of revenue growth requires expert leadership. At Shiny, we connect you with a network of over 3,000 vetted fractional executives who can provide the strategic guidance you need without the full-time cost. Find the right leader to build your revenue engine today.