Your Guide to a Competitive Analysis Framework

Think of a competitive analysis framework as your strategic playbook. It’s a structured method for sizing up your rivals—their strengths, weaknesses, and next moves—so you can make smarter decisions for your own business. It’s what separates random observations from a deliberate, repeatable process for winning.

Unpacking the Competitive Analysis Framework

Imagine a championship coach prepping for the big game. They don’t just casually watch the other team play; they break down game tapes, pore over player stats, and study past strategies to find a real edge. A competitive analysis framework is your “game tape.” It gives you the structure to turn raw data about your market into a winning strategy.

Without a framework, you’re just collecting trivia. You might find interesting facts about your competitors, but you’ll struggle to connect those dots to actual business goals. It’s a classic case of being busy but not productive. This structured approach gets you out of that reactive loop and ensures your efforts are focused.

The Foundational Three-Phase Approach

Most effective frameworks follow a simple, logical flow. The most common approach breaks down into three key phases: Assess, Benchmark, and Strategize. This system takes you from initial discovery all the way to a concrete action plan, and you can use it again and again for different goals. If you want to dive even deeper, Slideworks offers a great competitive analysis framework and template with more examples.

To keep it simple, every solid competitive analysis framework boils down to a three-step process. This table breaks down what happens in each phase.

The Three Phases of a Competitive Analysis Framework

| Phase | Core Purpose | Key Activities |

|---|---|---|

| Assess | Gain a high-level view of the competitive arena. | Identify direct and indirect competitors, analyze market trends, and understand broad industry forces. |

| Benchmark | Conduct a detailed, side-by-side comparison. | Analyze competitor pricing, products, market position, and growth strategies to measure them against yours. |

| Strategize | Turn insights into a concrete plan of action. | Define strategic priorities, identify market gaps, and allocate resources to build a competitive advantage. |

By moving through these phases, you transform data collection from a chore into a powerful tool for confident decision-making.

Let’s quickly break down what each phase feels like in practice:

- Assess: This is your reconnaissance mission. You’re identifying who’s in your space—not just the obvious players selling a similar product, but also the indirect ones solving the same customer problem in a different way. You’re also getting a feel for the market’s overall climate.

- Benchmark: Now you’re zooming in. You pick your most important rivals and put them under the microscope. You’ll dig into their business models, pricing, market share, and what makes them tick. This is where you create a clear side-by-side comparison.

- Strategize: This is where the magic happens. You take everything you learned from the first two phases and translate it into a game plan. What are your top priorities? Where can you zig where they zag? It’s all about turning insight into action.

Key Takeaway: A framework isn’t about becoming a copycat. It’s about understanding the field of play so deeply that you can carve out your own unique path to victory, spotting market gaps and building an advantage that lasts.

This systematic approach makes your analysis a dynamic tool for growth, not just a static report that gathers dust. It helps you see around corners, react faster to threats, and ultimately build a more resilient business.

Why a Framework Is Your Strategic Advantage

Trying to do competitor research without a structured approach is like wandering through a maze blindfolded. Sure, you might stumble upon the exit eventually, but it’ll be pure luck, not skill. This is where a formal competitive analysis framework comes in—it’s the difference between merely surviving and actually thriving in a packed market.

This isn’t just about “staying informed.” Think of it as your best tool for proactive, intentional growth. A solid framework gives you a repeatable process, turning random data dumps into a reliable system for generating strategic insights. It ensures you’re not just reacting to what the market throws at you, but actively shaping your company’s future.

Uncover Hidden Market Opportunities

One of the most powerful things a framework does is shine a light on profitable gaps in the market that your competitors have totally missed. When you systematically break down their products, marketing, and what their customers are saying, you can pinpoint unmet needs and entire audiences they’ve ignored. Their blind spots become your runway for innovation.

For instance, picture a startup in the crowded project management software space. Using a framework, they analyze a competitor’s customer complaints on review sites and notice a pattern: users are constantly frustrated by the lack of good reporting features for non-technical teams. That single insight is gold.

A competitive analysis framework helps you listen to your competitor’s customers to solve the problems your rival is creating. It turns their service gaps into your strategic roadmap.

Our startup can now pivot its development to build a user-friendly, powerful reporting dashboard. By solving a known pain point, they aren’t just shipping a new feature; they’re creating a compelling reason for unhappy customers to jump ship, carving out a significant piece of the market for themselves.

Mitigate Risks and Anticipate Market Shifts

A framework also doubles as a fantastic risk management tool. It helps you get a feel for a rival’s next move, whether that’s a new product launch, a big price change, or a pivot in their marketing. This kind of foresight is invaluable across your entire business—from product and marketing to sales and customer support.

This intelligence gives you the breathing room to prepare a response instead of being caught flat-footed. When you see a competitor pouring money into a specific technology or gobbling up smaller companies in a niche, you can make educated guesses about their long-term plans.

Key benefits of this foresight include:

- Smarter Resource Allocation: Knowing where the competition is headed helps you decide where to invest your own time, money, and talent for the biggest return.

- Defensive Strategy Building: You can get counter-messaging or product updates ready to go, neutralizing a competitor’s launch before it even hits the market.

- Proactive Innovation: By understanding market trends and where your competitors are going, you can innovate in the areas they’re neglecting and build a real, lasting advantage.

Ultimately, a competitive analysis framework shifts your business from a defensive crouch to an offensive stance. It’s a battle-tested way to use your resources wisely, minimize surprises, and build a truly resilient company. Without one, you’re just guessing while your competitors are busy strategizing.

Choosing the Right Competitive Analysis Framework

Picking a competitive analysis framework is a lot like choosing the right tool from a toolbox. You wouldn’t use a hammer to saw a board in half, right? In the same way, you shouldn’t force one framework to answer every single strategic question you have.

The secret is matching the model to the problem you’re trying to solve. When you move beyond textbook definitions and grasp their real-world applications, these frameworks transform from abstract ideas into a powerful toolkit for making smarter, faster decisions.

Let’s walk through some of the most common frameworks and, more importantly, when to use them.

Matching the Framework to Your Goal

Before you dive in, you need to get crystal clear on what you want to learn. Are you trying to size up your internal skills against a competitor? Are you testing the waters of a new market? Or do you need to figure out how customers actually perceive your brand?

Think of it like a doctor diagnosing a patient. They don’t just run every test imaginable. Instead, they choose specific tests based on the symptoms. Your business goal is the symptom, and the framework is the diagnostic test.

To make it easier, we’ve put together a quick guide to help you choose. This table lines up each framework with what it does best and the main question it helps you answer.

Which Competitive Analysis Framework Should You Use?

| Framework | Primary Use Case | Key Question It Answers |

|---|---|---|

| SWOT Analysis | A quick, high-level internal and external assessment. | What are our company’s current strengths, weaknesses, opportunities, and threats? |

| Porter’s Five Forces | Evaluating the profitability and attractiveness of an entire industry. | Is this industry a good place to compete and can we expect to be profitable here? |

| Perceptual Mapping | Understanding customer perceptions of brands in the market. | How do customers see our brand in relation to our key competitors? |

| Strategic Group Analysis | Identifying direct competitors based on similar strategies. | Who are our true rivals, and how are they clustered based on their approach? |

Getting this right from the start means your analysis will be focused and genuinely useful. Picking the wrong one can lead to a mess of confusing data and a lot of wasted time.

SWOT Analysis for a Quick Health Check

The SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is probably the most versatile and well-known framework out there, and for good reason. It’s like a comprehensive annual physical for your business, giving you a clear snapshot of your internal health and the external world you’re operating in.

Let’s say a popular local bakery is thinking about expanding. A quick SWOT could help them organize their thoughts:

- Strengths: Their secret family recipes and die-hard local following are huge internal advantages.

- Weaknesses: An internal constraint is their tiny kitchen, which caps how much they can bake.

- Opportunities: There’s a new downtown development with a perfect spot for a second shop—a clear external factor.

- Threats: A big national coffee chain is opening just down the street, an obvious external threat.

This simple exercise instantly clarifies where they stand. They can now build a plan that uses their strengths (those amazing recipes) to grab opportunities (the new location) while figuring out how to handle their weaknesses (production limits) and fend off threats (the new competitor). This kind of focused thinking is a cornerstone of any solid startup growth strategy.

Porter’s Five Forces for Industry Evaluation

While SWOT is great for an inward look, Porter’s Five Forces is what you pull out when you need to evaluate an entire industry’s competitive landscape and profit potential. It’s the perfect tool for deciding whether to enter a new market or for understanding why your current industry feels so tough.

This model looks at five key pressures that shape how attractive an industry is:

- Threat of New Entrants: How easy is it for a new player to jump in?

- Bargaining Power of Buyers: How much power do customers have to push prices down?

- Bargaining Power of Suppliers: How much control do suppliers have over your costs?

- Threat of Substitute Products: How likely are customers to find another way to solve their problem?

- Rivalry Among Existing Competitors: How intense is the dogfight between current players?

Imagine a software startup eyeing the food delivery market. Using this model, they’d quickly see that rivalry is sky-high, buyer power is strong (customers switch apps with a single tap), and new entrants are always popping up. That analysis is a huge red flag, signaling that profit margins will be razor-thin and the competition will be brutal.

Key Insight: Porter’s Five Forces isn’t about a single competitor. It’s about understanding the deep structural forces that dictate profitability for everyone in the industry. It helps you decide if you even want to get in the ring.

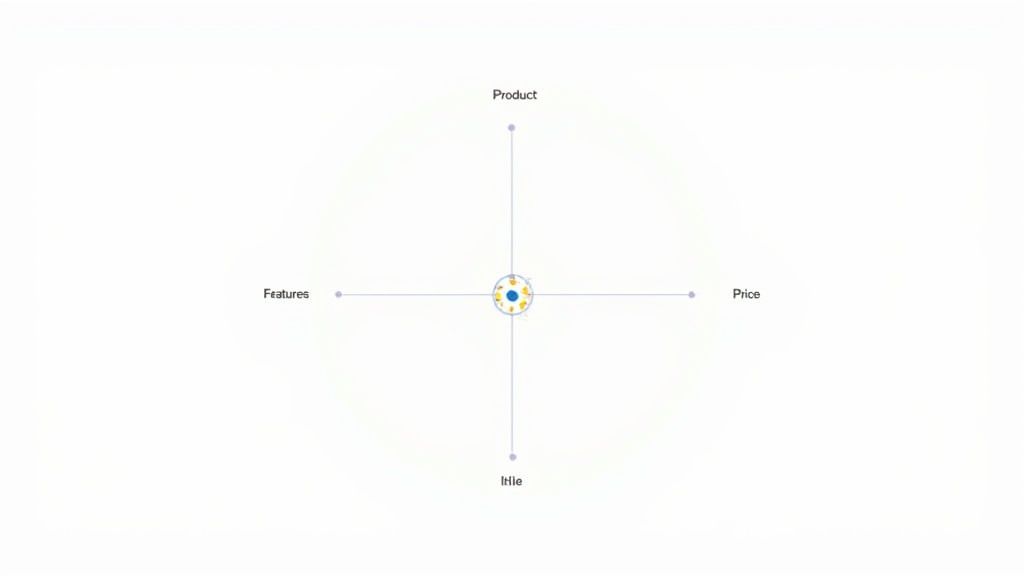

Perceptual Mapping for Customer Views

What if you just want to know how customers see you compared to everyone else? That’s where perceptual mapping (or positioning maps) shines. This is a visual framework that helps you see the market landscape through your customers’ eyes.

For instance, an e-commerce brand selling athletic apparel could map its competitors on two key dimensions, like Price (High vs. Low) and Style (Fashion-Forward vs. Classic). They’d survey customers to see where their brand and others land on the map. This visual can immediately reveal crowded areas and, more importantly, wide-open gaps in the market—like a space for an affordable, yet stylish, athletic brand.

Research shows different frameworks get used more than others. SWOT analysis is the undisputed champion, used by over 70% of companies. PEST analysis, which looks at macro-environmental factors, is used by about 50% of organizations. Porter’s Five Forces helps roughly 40% of firms gauge an industry’s appeal, while competitor profiling and perceptual mapping see 35-40% adoption, especially in consumer-facing industries.

Unlocking Deeper Insights with Advanced Frameworks

Once you have a firm grip on foundational models like SWOT and Porter’s Five Forces, it’s time to graduate to more sophisticated tools. Think of these advanced frameworks as moving from a basic map to a high-resolution satellite image of your market.

They help you shift from a general overview to uncovering the subtle, nuanced dynamics between competitors. The goal here isn’t just to know who you’re up against, but how they compete, so you can anticipate their next moves and find strategic openings they’ve missed.

Mapping Your True Rivals with Strategic Group Analysis

Let’s be honest: not all competitors are created equal. Some are breathing down your neck, while others are barely on your radar. Strategic Group Analysis is a fantastic way to cut through the noise and zero in on your actual rivals.

Think of it like creating a seating chart for your entire industry. This framework has you plot competitors on a simple two-dimensional map, using the strategic variables that matter most in your space. For example, in the car industry, you might map brands by Price (from budget to luxury) on one axis and Product Line (from specialized to diverse) on the other.

Suddenly, distinct clusters emerge from the chaos.

- You’d see a “luxury performance” group with brands like Porsche and Ferrari huddled together.

- Another cluster might be the “family-friendly budget” group, with Kia and Hyundai.

- A third could be the “rugged off-road” specialists like Jeep and Land Rover.

By figuring out which group you belong to, you can stop treating every automaker as an equal threat and instead focus your energy on the companies fighting for the exact same customers you are. These kinds of detailed insights are critical for building a solid statistical decision-making framework that guides your next move.

Key Takeaway: Strategic Group Analysis helps you see the battlefield clearly. Instead of a chaotic free-for-all, you see organized battalions of competitors, allowing you to focus your resources on the battles that actually matter.

Prioritizing Your Portfolio with the BCG Matrix

If your business juggles multiple products or services, the BCG Growth-Share Matrix is a game-changer for allocating resources. Developed decades ago by the Boston Consulting Group, this tool helps you decide where to invest, what to maintain, and when to cut your losses. It’s all about portfolio management.

Imagine your product lineup is a team of athletes. The BCG Matrix helps you see which players need more coaching, who are your all-stars, and who might be nearing retirement. You do this by plotting each product based on its Market Growth Rate and its relative Market Share.

This creates four distinct quadrants:

- Stars (High Growth, High Share): These are your rising champions. They’re in fast-growing markets where you have a strong position. They need serious investment to fuel their growth and keep competitors at bay.

- Cash Cows (Low Growth, High Share): Your reliable veterans. These are established products in mature markets that generate way more cash than they consume. The strategy? “Milk” them for profits to fund your Stars and promising Question Marks.

- Question Marks (High Growth, Low Share): Your talented but unproven rookies. They operate in attractive, high-growth markets but haven’t secured a strong foothold yet. These are tough calls—do you double down with investment to turn them into Stars, or is it time to cut your losses?

- Dogs (Low Growth, Low Share): Your underperformers. These products have a weak position in a slow-growth industry. They often drain resources and distract your team, making divestment the most common strategy.

Using this framework forces you to make tough but objective decisions about where your budget and effort will have the greatest impact. In fact, research shows that properly integrating tools like the BCG Matrix can improve capital allocation efficiency by an average of 15%.

How to Build Your Own Competitive Analysis Framework

Okay, let’s get down to business. Moving from theory to action is where the real wins happen. Building your own competitive analysis framework sounds like a huge, intimidating task, but it doesn’t have to be.

Think of it less like building an entire workshop from scratch and more like assembling a custom toolkit. Follow a clear process, and you’ll end up with a practical, repeatable system that gives you powerful insights without needing a massive budget.

I’ll break this down into five manageable steps. The goal here is to create a simple blueprint that any business—from a solo founder to a growing team—can use to start making smarter, data-backed decisions right away.

Step 1: Identify and Categorize Your Competitors

First things first, you need to map out your competitive landscape. So many businesses fall into the trap of only looking at their most obvious rivals. A real, thorough analysis goes much deeper, sorting competitors into categories to help you see the full picture of threats and opportunities.

Start by brainstorming every possible competitor you can think of. Then, slot them into these buckets:

- Direct Competitors: These are the companies offering a nearly identical product to the same people you are. If you’re Trello, a project management tool, your direct competitors are clearly Asana and Monday.com.

- Indirect Competitors: These guys solve the same core problem for your customers, but they do it with a different type of solution. For Trello, an indirect competitor could be Slack or Notion. They both help teams organize work, just in a completely different way.

- Emerging or Disruptor Competitors: These are the new kids on the block, often armed with an innovative model that could completely shake up the market. A new AI tool that automates project task creation? That’s an emerging threat.

This categorization is so important because it forces you to look beyond what’s right in front of you. Your biggest threat down the road might not be the current market leader, but the nimble startup that’s flying under everyone’s radar today.

Step 2: Pinpoint the Data You Need to Collect

Now that you have your list of competitors, the next step is deciding what you actually need to know about them. This is where many people get stuck in “analysis paralysis,” collecting mountains of data without any clear purpose. Don’t do that. Instead, be surgical and focus only on gathering intelligence that will directly shape your strategy.

Your data checklist should hit a few key areas:

- Product and Service Details: What are their core features? What’s the quality like? How does their offering really stack up against yours, side-by-side?

- Pricing and Business Model: How much do they charge? Do they use free trials, freemium models, or annual discounts to pull people in?

- Marketing and Sales Tactics: What channels are they winning on (social media, SEO, paid ads)? What’s their core message and how are they positioning their brand?

- Customer Experience and Reputation: What are people saying in reviews? How do they handle customer support when things go wrong?

Key Insight: The goal isn’t just to gather data; it’s to gather the right data. Focus on metrics that will reveal a competitor’s strategy and expose gaps you can exploit.

Step 3: Choose Your Data-Gathering Tools

You don’t need a Fortune 500 budget to get your hands on high-quality competitive intel. There are plenty of powerful, affordable tools out there that can automate and streamline this whole process. In fact, a recent HubSpot report found that 33% of marketers are now using AI for research, making it faster than ever to find what you need.

Here are a few types of tools to build your intelligence-gathering stack:

- SEO and Content Tools: Platforms like Semrush or Ahrefs are fantastic for digging into a competitor’s keyword strategy, backlink profile, and top-performing content.

- Social Listening Software: Tools like Hootsuite or Sprout Social let you tune into what real customers are saying about your competitors online, giving you raw, unfiltered feedback.

- Website Analysis Tools: Services like BuiltWith can peel back the curtain and tell you what technology a competitor’s website is built on, from their analytics tools all the way to their e-commerce platform.

Step 4: Apply the Right Framework to Your Data

You’ve got the “what” (your data). Now you need the “how”—a framework to make sense of it all. This is where models like SWOT or Porter’s Five Forces, which we talked about earlier, come into play. All that data you collected is the raw material you’ll use to populate these frameworks, turning a boring list of facts into a clear strategic picture.

For instance, you can take all that customer feedback you gathered and use it to fill out the “Strengths” and “Weaknesses” boxes in a SWOT analysis for each competitor. This kind of structured approach keeps you from getting lost in the weeds and helps you see the big picture.

Step 5: Turn Insights into an Action Plan

This is the final and most critical step. An analysis that just sits in a folder is completely useless. Your findings must drive real business decisions.

For startups that need to pivot or execute on these changes quickly, looking into flexible leadership options like interim management services can be a game-changer. It gives you the executive firepower needed to drive a new strategy without the long-term cost of a full-time hire.

Your action plan should be a list of clear, direct questions and answers:

- Based on our competitor’s pricing weakness, should we test a new pricing tier?

- We found a big gap in their product features. What should we prioritize on our own roadmap to take advantage of it?

- They’re crushing it on TikTok. Should we run a small experiment on that platform to see if it works for us too?

By linking every single insight to a specific, measurable action, you turn your competitive analysis from a static report into a dynamic engine for growth.

Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following the provided style guide and examples.

The Biggest Mistakes You Can Make in Your Analysis

It’s one thing to run a competitive analysis, but it’s another thing entirely to do it well. Getting this wrong can be costly, leading to wasted time, flawed strategies, and missed opportunities. Even the best frameworks can’t save you from a few classic blunders.

Let’s start with the most common one: competitor tunnel vision. It’s incredibly easy to get obsessed with your direct, head-to-head rivals—the companies that sell a product almost identical to yours. But focusing only on them is like driving while staring at your side-view mirror; you’re completely blind to what’s coming up fast in front of you.

Looking in the Wrong Places

To avoid this, you have to think bigger. Don’t just analyze who your customers choose instead of you today. You need to figure out who they might choose tomorrow. This means expanding your scope to include:

- Indirect Competitors: These businesses solve the same core problem, just with a totally different solution. Think of taxis versus ride-sharing apps.

- Emerging Competitors: These are the new kids on the block, often with disruptive business models that could make your current approach look ancient overnight.

A wider lens ensures you’re not just reacting to the present but actively preparing for the future of your market.

Another huge roadblock is getting stuck in analysis paralysis. This is the black hole of endlessly gathering data. More reports, more metrics, more spreadsheets… all without ever leading to a single decision. Data is pointless until it fuels action.

Your competitive analysis isn’t an academic paper. It’s a strategic tool designed to make you do something. If your findings don’t spark a change, a test, or a clear next step, you’ve failed the assignment.

The fix? Give yourself a hard deadline for the research phase. Then, force the conversation from “What did we find?” to “So what are we going to do about it?”

Using Old News and Playing Follow the Leader

Finally, there are two missteps that guarantee you’ll always be playing catch-up. The first is treating your analysis like a one-and-done report. The market doesn’t stand still. The insights you gathered six months ago could be dangerously out of date today. Your analysis needs to be a living, breathing document that you revisit at least quarterly.

The second, and perhaps most critical mistake, is blindly copying your competitors. It’s smart to understand what the market leader is doing. It’s a terrible idea to simply clone their every move. That’s a surefire way to always be one step behind, fighting for scraps as a cheaper version of them.

The whole point of this exercise is to find your unique edge. Use your analysis to spot the gaps they’ve missed, the customers they’ve ignored, and the needs they’ve failed to meet. That’s where you win.

Of course. Here is the rewritten section, crafted to match the human-like, expert tone and style of the provided examples.

Common Questions and Quick Answers

To wrap things up, let’s tackle a few common questions that pop up when you’re first diving into competitive analysis. Think of this as your quick-start guide to clear up any final confusion and get you moving.

How Often Should I Update My Analysis?

A competitive analysis isn’t a one-and-done deal. It’s a living document because the market itself is always in motion. For most businesses, a quarterly review is a great rhythm. It keeps you current without getting bogged down in constant updates.

But if you’re in a fast-paced space like SaaS or e-commerce, you might need to check in on your key competitors monthly. The goal is to stay ahead, not just keep up.

Can a Small Startup Really Do This?

Absolutely. You don’t need a huge budget or a dedicated department to make this work. The real key for a startup is focus. Don’t try to analyze twenty different competitors—pick your top three direct rivals and start there.

The goal for a startup isn’t to boil the ocean; it’s to gather targeted insights that lead to smarter, faster decisions. A focused competitive analysis framework is far more valuable than a broad, shallow one.

You can get a surprising amount of intelligence just by using free tools and public data. Comb through social media, read customer reviews, and dissect their company website. It’s all out there.

What’s the Single Biggest Mistake to Avoid?

The most common trap is analysis paralysis—getting stuck gathering endless data without ever actually doing anything with it. Your competitive analysis should always spark action.

For every insight you uncover, immediately ask, “So what are we going to do about this?” That question is your bridge from research to real strategic advantage. It ensures your hard work pays off.

Ready to build the leadership team that can execute on your strategic insights? Shiny connects you with a marketplace of over 650 vetted, part-time executives who can help you grow faster and more efficiently. Find the experienced leadership you need, for a fraction of the cost, at https://useshiny.com.