Essential Strategies for Reducing Operational Costs: A Modern Guide for Business Leaders

Understanding Today’s Cost Reduction Landscape

Companies are rethinking how they manage costs as business conditions continue to shift. The old approach of making reactive budget cuts is no longer enough – organizations need thoughtful, long-term strategies that align with their goals while maintaining operational effectiveness. This requires a deep understanding of the current economic environment and its impact on cost management.

The Current Economic Climate and its Impact

Recent economic pressures have pushed many businesses to carefully examine their spending. According to S&P Global, US investment-grade companies significantly reduced their operating expenses in Q1 2023, with total costs dropping by 5.3% from $3.023 trillion to $2.858 trillion. The energy sector saw expenses fall by over 13%, while consumer discretionary companies cut costs by more than 10%. Read the full S&P Global report for more details on these trends.

Evolving Cost Reduction Methods

Forward-thinking companies are moving beyond basic cost-cutting to find smarter ways to manage expenses. Many are using data analysis and technology to spot inefficiencies and areas for improvement. Just as important is building what we call a cost-conscious culture – getting everyone in the organization to think carefully about how resources are used. This is similar to developing healthy habits – it’s not about quick fixes but creating lasting positive changes.

Sector-Specific Considerations

Different industries face unique cost challenges that require targeted solutions. Energy companies often focus on optimizing power usage and exploring renewable options, while consumer goods businesses typically look at supply chain and inventory improvements. This focused approach helps ensure that cost reduction efforts address the specific needs and opportunities in each sector. Understanding these industry differences is key to developing cost strategies that deliver real results.

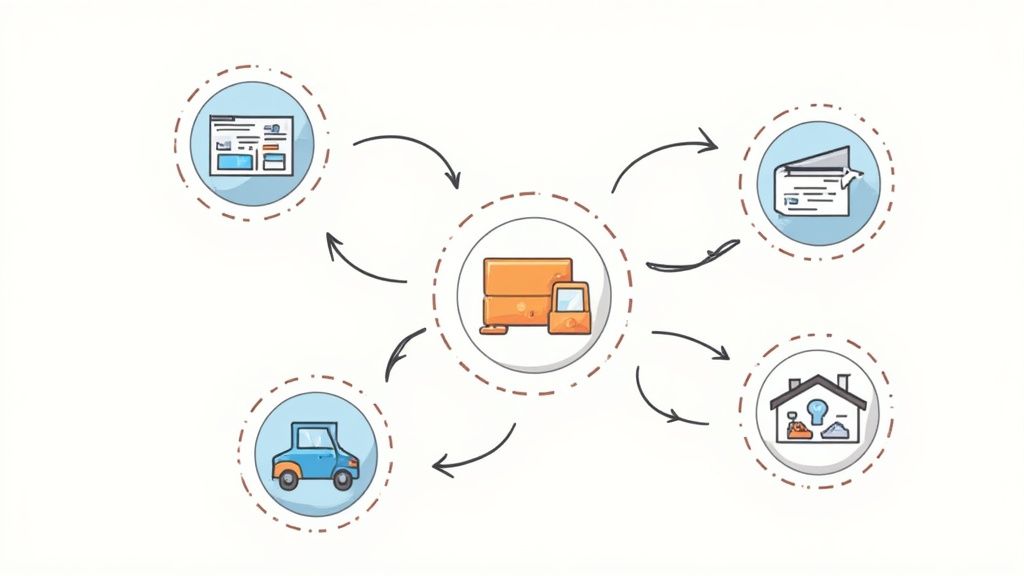

From Cost-Cutting to Strategic Cost Management

Simply reducing budgets rarely delivers lasting results. Leading companies are moving beyond quick fixes and adopting strategic cost management – viewing costs not as a burden but as a potential competitive edge. This shift focuses on enhancing processes, boosting efficiency, and ensuring cost decisions support broader business goals.

The Evolution of Cost Management

Cost management has been central to business strategy since the early days of scientific management. Frederick W. Taylor, an early pioneer, focused on optimizing resources through methods like specialized labor division. While his approach faced criticism, it laid groundwork for many modern practices. For deeper background, see insights on scientific management’s history. Today’s successful approach requires proactive planning and integration across the organization.

Building a Cost-Conscious Culture

A key element is developing a cost-conscious culture where employees naturally consider financial impact in daily decisions. Rather than enforcing strict rules, this empowers people to spot improvement opportunities and contribute ideas. Success requires consistent leadership support and reinforcement over time.

Aligning Costs with Growth

Consider a startup investing in automated customer support tools. While this requires upfront spending, it can reduce long-term costs by limiting customer service headcount. Those savings can then fund product development and marketing that drive growth. This shows how strategic cost management enables rather than restricts expansion.

Creating Sustainable Cost Frameworks

Effective cost management needs ongoing systems, not one-time changes. Key elements include:

- Clear cost reduction targets

- Metrics to track progress

- Regular reviews to find improvements

- Implementation monitoring

Building these practices into company culture ensures continuous improvement rather than reactive cost-cutting. This proactive, systematic approach sets successful initiatives apart from short-term fixes.

The Power of Technology to Drive Down Costs

Technology unlocks new ways for businesses to run efficiently and cut costs in specific, measurable ways. By implementing smarter tools and processes, companies can save substantially while building stronger operations. Let’s explore how this works in practice.

AI-Driven Optimization

AI improves business operations by providing data-backed insights. For instance, AI models can analyze patterns to accurately predict customer demand, optimizing inventory levels and avoiding excess stock. This practical use of AI has helped companies reduce storage costs and minimize product waste.

Manufacturing plants, retail stores, and logistics companies use AI algorithms to spot operational bottlenecks and identify areas for cost savings. The continuous monitoring and analysis is like having a highly capable analyst working around the clock to find ways to improve.

Smart Automation in Action

Process automation directly impacts the bottom line. For example, Robotic Process Automation (RPA) handles routine administrative tasks, allowing employees to focus on strategic work that drives more value. When companies automate report generation, teams can spend their time analyzing insights and making decisions rather than gathering data.

Manufacturing facilities see major benefits too. Automated systems help optimize production lines, reducing material waste and cutting energy usage. The savings quickly add up as efficiency improves across the operation.

Getting Practical Value from Digital Changes

Moving processes to cloud platforms provides quick cost reductions. For example, switching to cloud accounting software eliminates expenses for server hardware, maintenance, and software updates. This frees up resources that can go toward core business needs.

Even small digital changes make a difference. Moving from paper to digital communication tools cuts printing and mailing costs. Over time, these types of targeted digital upgrades deliver measurable savings.

The Growing Impact of Green Tech

Many businesses now see major savings from sustainable technologies. Data from the National Renewable Energy Laboratory (NREL) shows dramatic cost declines in solar energy systems between 2010-2020:

- 64% drop in residential system costs

- 69% reduction for commercial rooftop systems

- 82% decrease in utility-scale installations

These numbers show how green tech investments pay off through lower operational costs while supporting environmental goals.

Breaking Through Cost Reduction Barriers

Most companies find it challenging to make meaningful progress on cost reduction goals. While reducing expenses is vital for business success, many initiatives fail to deliver the expected savings. Let’s explore the key barriers and practical ways to overcome them.

Understanding the Challenges

One of the biggest obstacles is resistance to change from employees. Staff members often worry about potential job losses, heavier workloads, or disruptions to their routines. Without clear communication and support from leadership at all levels, even well-planned cost initiatives can falter. This highlights why the human element needs careful consideration.

Another common issue is keeping the momentum going over time. Initial enthusiasm tends to fade as projects drag on, especially when quick wins prove elusive. For instance, if teams don’t see clear progress metrics and regular updates, they may lose focus and motivation. Teams need consistent tracking and reinforcement to stay engaged.

The scale of this challenge becomes clear in Deloitte’s research findings. Their global survey revealed that 81% of companies fell short of their cost reduction targets, despite focusing heavily on improving business processes. You can find the complete data here. This underscores the need for better planning and execution.

Strategies for Success

Getting past these barriers requires several key actions. First, build broad support throughout your organization. Be upfront about why changes are needed, what benefits to expect, and how employees will be affected. Open conversations that address concerns early on can reduce pushback and create shared commitment.

Second, set realistic goals with specific metrics to track progress. Share regular updates on key numbers and celebrate small wins along the way. For example, recognizing a team that identifies $50,000 in annual savings can motivate others to find similar opportunities in their areas.

Third, stay flexible and adapt based on what’s working. Regularly check in with teams, identify what’s blocking progress, and adjust plans as needed. An agile approach helps initiatives stay on track even when facing unexpected hurdles.

Risk Assessment and Mitigation

Planning ahead for potential problems is essential. Identify likely risks early and develop backup plans. For example, if implementing new technology hits delays, having alternative approaches ready can prevent the whole initiative from stalling. Being prepared helps teams push through challenges while maintaining focus on reducing costs.

Mastering Financial Integration for Cost Efficiency

Financial integration is a smart strategy for businesses looking to cut operational costs. By bringing together disconnected systems and processes, companies can analyze their data better and make smarter decisions. Let’s explore the key approaches that successful organizations use.

Identifying Opportunities for System Consolidation

Most companies run multiple financial systems that don’t talk to each other well. This creates information silos and forces staff to manually move data between systems, making it hard to see the full financial picture. Moving to a single platform saves money on IT costs, software licenses, and technical support. For instance, combining separate accounting and expense tracking systems eliminates duplicate software costs. It also helps prevent errors that happen when manually copying data between systems.

Streamlining Financial Processes Through Integration

When financial systems work together smoothly, key tasks like processing invoices and creating reports can be automated. This saves valuable time and reduces human error. Consider a company that handles hundreds of monthly invoices by hand – this takes up staff time and leads to mistakes. Integrating systems to automate invoice processing lets employees focus on more valuable work instead.

Connecting financial data with other business systems like CRM and ERP platforms provides deeper insights into company performance. This helps identify ways to optimize costs and improve planning. Just as an orchestra needs a conductor with the full score, businesses need integrated financial data to run effectively.

Leveraging Data Analytics for Improved Decision-Making

Integrated financial systems create a rich source of information to guide smarter choices. By analyzing spending patterns, cost drivers, and key metrics, companies can replace guesswork with data-driven strategies for managing costs. The European Central Bank has shown this through initiatives like SEPA that consolidate payment systems for better efficiency. Learn more about their financial integration work here.

Measuring and Optimizing Financial Integration Initiatives

Successfully reducing costs through integration requires careful planning and monitoring. Companies should establish clear metrics to track their progress, including cost savings, process improvements, and reporting accuracy. Regular review of these metrics allows for adjustments as needed. Like tuning an instrument, this iterative approach helps organizations optimize their financial operations over time.

Building Your Sustainable Cost Reduction Roadmap

Creating lasting cost reduction requires a methodical approach – like building a reliable engine that keeps running efficiently over time. The key is developing clear goals, effective tracking methods, and a culture where everyone takes ownership of cost management.

Defining Clear and Measurable Objectives

Start by setting specific goals you can actually measure and achieve. Rather than a vague target like “cut costs,” aim for concrete metrics such as “reduce energy usage by 15% within 12 months.” Having precise goals helps everyone understand what success looks like and allows you to track real progress. Think of it like using GPS navigation – you need an exact destination to plot the best route.

Building a Robust Measurement System

Once you have clear goals, you need reliable ways to measure progress. Choose Key Performance Indicators (KPIs) that directly show the impact of your cost-saving efforts. For example, if you want to reduce customer service expenses, track metrics like average call handling time and first-contact resolution rates. These measurements act like gauges on your dashboard, helping you monitor performance and spot areas needing attention.

Creating Accountability Structures

Make cost management part of your company’s DNA by clearly defining who owns what. Assign specific people to lead each cost reduction initiative and hold regular check-ins to review progress. Provide recognition when teams hit their targets and constructive feedback when efforts fall short. This creates a sense of ownership and keeps everyone focused on continuous improvement.

Practical Tools and Implementation Guidelines

Moving from plan to action requires the right tools. Here are some essential resources to help you get started:

- Cost Analysis Templates: Structured tools for reviewing spending patterns and finding savings opportunities

- Process Mapping Tools: Visual guides to identify bottlenecks and waste in your workflows

- Project Management Software: Systems to track tasks and measure progress

Regular reviews using these tools will help you build a dynamic cost reduction plan that evolves with your business needs.

Looking for experienced leadership to guide your startup’s growth and optimize costs? Shiny connects you with proven fractional executives across industries. Explore Fractional Executives with Shiny