A Founder’s Guide to Financial Forecasting for Startups

Financial forecasting for startups isn't just about crunching numbers; it's about creating a strategic roadmap for your company's future. It’s how you predict revenue, map out expenses, and monitor cash flow, empowering you to make informed decisions instead of relying on gut feelings. A solid forecast is essential for securing investment, managing resources wisely, and steering your business toward sustainable growth.

Why Financial Forecasting Is Your Startup's Roadmap

Running a startup on intuition alone is like trying to navigate the open sea without a compass. While your gut is a powerful tool, it won't warn you about a looming cash flow crisis or identify your most profitable customer segment. Financial forecasting is your essential navigation tool, providing the data-driven clarity needed to lead with confidence and turn vague goals into a concrete, actionable plan.

Think of your forecast as a flight plan. It helps you anticipate turbulence (like a market downturn), determine the right altitude (your pricing strategy), and chart a clear course to your destination (profitability). Without it, you're flying blind, simply reacting to problems instead of proactively navigating around them.

From Reactive Management to Proactive Strategy

A well-built forecast is the bridge from reactive crisis management to proactive, strategic leadership. Instead of scrambling when cash gets tight, you can anticipate the crunch months in advance and make necessary adjustments. This foresight is what allows you to make smart, timely choices that impact every part of your business.

With a reliable financial forecast, you can answer critical growth questions with data, not just hope:

- When can we actually afford that key developer? Your forecast ties hiring plans directly to revenue milestones and your cash balance.

- How much should we really put into the marketing budget? It lets you model how different spending levels could impact customer acquisition and growth.

- Can we handle a discount promotion this quarter? You can simulate the impact on your margins and cash flow before you commit.

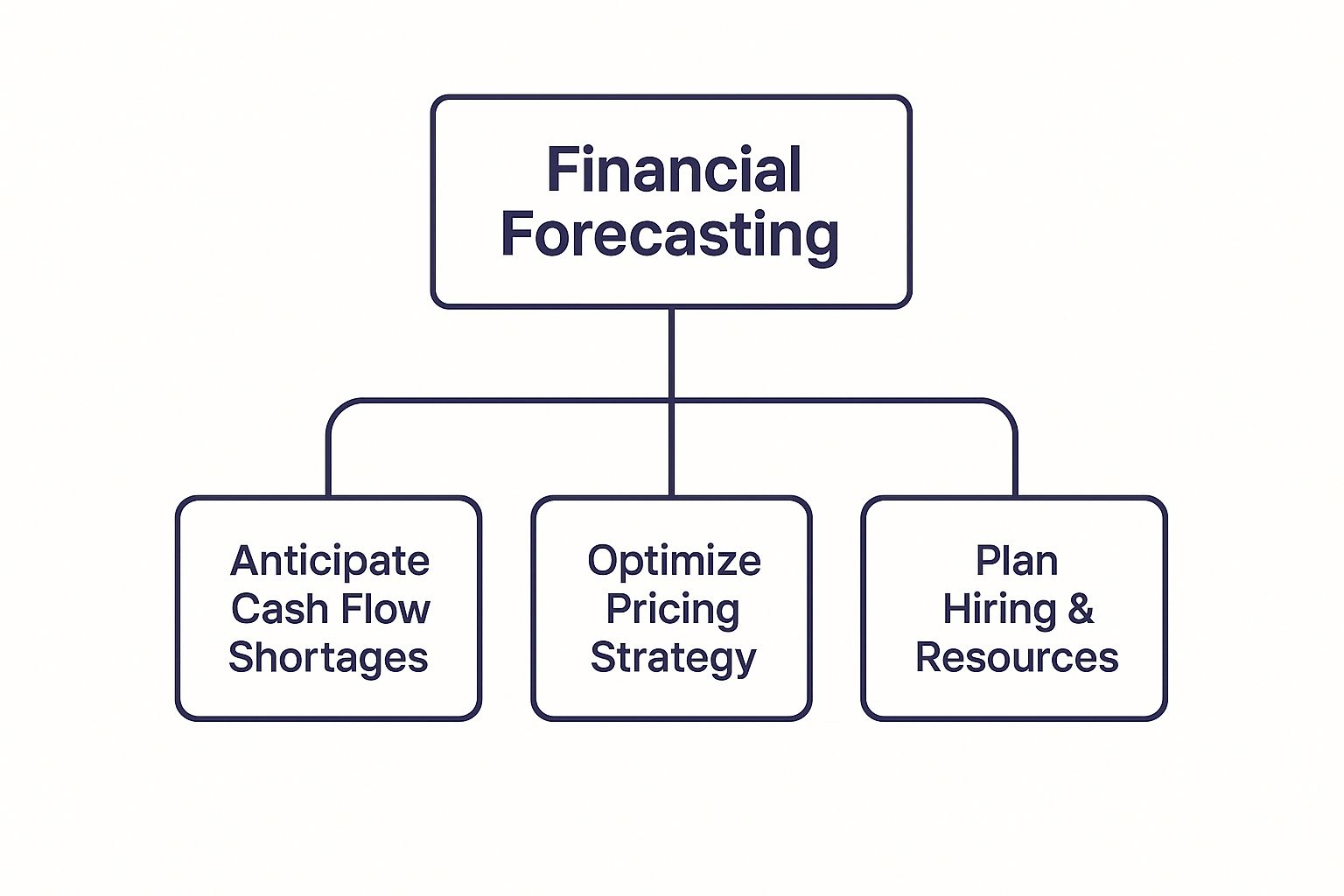

This infographic shows just how central a financial forecast is to all your key strategic decisions.

As you can see, a single, coherent forecast informs everything from resource allocation to your core pricing model. It’s what keeps all your strategic efforts aligned and financially grounded.

Building Credibility and Aligning Your Team

Beyond internal planning, financial forecasting for startups is the language you use to speak with investors. A defensible forecast demonstrates a deep, nuanced understanding of your business and market. It builds incredible credibility and shows potential backers that their capital will be managed with strategic foresight.

A forecast is more than a spreadsheet; it's the narrative of your company's future. It tells a story of ambition grounded in reality, which is exactly what investors want to see.

The process also has a powerful internal effect: it aligns your entire team. When everyone from sales to product development understands the financial targets and how their work contributes to them, you create a unified force pulling in the same direction. Abstract numbers are transformed into shared, meaningful objectives.

Understanding The Three Pillars Of Forecasting

To build a reliable financial forecast, you must first understand its three foundational components. These aren't just accounting documents; they are the bedrock of your startup's financial story. Think of them as three distinct lenses, each providing a unique and critical view of your company's health and trajectory.

Let's use a simple analogy: a lemonade stand. At the end of the day, you want to know how you performed. These three statements answer that question from different, equally vital angles.

The Income Statement: Your Scoreboard

The Income Statement, often called the Profit and Loss (P&L), is your business's scoreboard. It tells you whether you won (made a profit) or lost (incurred a loss) over a specific period, like a month or a quarter. The formula is simple: Revenue – Expenses = Profit/Loss.

For your lemonade stand, the P&L would show revenue from lemonade sales. It would then subtract the cost of lemons, sugar, and cups (Cost of Goods Sold) and any marketing flyers you printed (Operating Expenses). The final number reveals your net profit or loss for the day.

It answers the question: "Did we make money?"

The Balance Sheet: A Snapshot In Time

While the Income Statement measures performance over time, the Balance Sheet is a snapshot of your startup’s financial health at a single moment. It’s based on the fundamental accounting equation: Assets = Liabilities + Equity. It lists everything your company owns (assets) and everything it owes (liabilities and owner's equity).

At the lemonade stand, your assets include the cash in your jar and the value of leftover inventory. Your liabilities might be the $5 you borrowed from a friend to get started. The Balance Sheet provides a clear picture of your net worth at that exact moment.

It answers the question: "What is the company's financial position right now?"

The Cash Flow Statement: Your Fuel Gauge

For any startup, this is the most critical statement. The Cash Flow Statement is your business’s fuel gauge, tracking the actual cash moving in and out of your bank account. Profitability on paper is meaningless without the real cash needed to pay bills, salaries, and suppliers.

Imagine you sold $100 worth of lemonade, but your biggest customer paid with an IOU. Your Income Statement would show a $100 profit. But your Cash Flow Statement would reveal the real story: you don't have that cash yet. This distinction is precisely why cash is king.

This statement answers the most urgent question for any founder: "Do we have enough cash to survive and grow?"

For startups, the Cash Flow Statement is non-negotiable. It reveals your true runway—how many months you can operate before you run out of money. An investor will scrutinize this more than any other document.

Understanding how these three statements work together is the key to effective financial forecasting for startups. Your Income Statement might show killer profits, but your Cash Flow Statement could be flashing a dangerous cash shortage warning. They’re all interconnected, painting a complete picture that leaders and investors rely on to make smart decisions.

Forecasting helps set ambitious yet plausible growth targets. For instance, an analysis of over 140,000 startups found that the average forecasted revenue growth is a staggering 522% in year one, cooling to 236% in year two. This reflects the high-growth mindset that must be backed by solid financial storytelling. You can explore more on startup growth benchmarks to see how your projections stack up.

The Three Pillars of Financial Forecasting

| Financial Statement | What It Measures | Key Question It Answers |

|---|---|---|

| Income Statement (P&L) | Profitability over a specific period (e.g., month, quarter, year). | "Are we making or losing money?" |

| Balance Sheet | Financial health at a single point in time. | "What is our company's net worth right now?" |

| Cash Flow Statement | The movement of actual cash in and out of the business. | "Do we have enough cash to operate and grow?" |

Each statement provides a different piece of the puzzle. When you learn to read them together, you unlock a complete, three-dimensional view of your startup's financial reality.

How To Build Your First Financial Forecast

Now that you understand the theory, it's time to build your first forecast. The only credible way for a startup to do this is with a bottoms-up forecast. Forget taking a massive market size number and claiming you'll capture 1% of it (a top-down approach investors see right through). Instead, we’ll build your financial picture from the ground up, using real business drivers you can control.

Think of it like building a house. You start with a solid foundation, not the roof. For your forecast, that foundation rests on three pillars: revenue, direct costs, and operating expenses.

Let’s walk through it step-by-step.

Start With Revenue Projections

Your revenue forecast is the engine of your entire financial model. A guess here will make every subsequent number wrong. Instead of pulling numbers from thin air, anchor your projections to specific, measurable activities.

For a SaaS company, this looks something like:

- Website Traffic: How many visitors can you realistically drive to your site each month?

- Trial Sign-up Rate: What percentage of those visitors will sign up for a free trial?

- Conversion Rate: Of those who start a trial, how many will become paying customers?

- Average Revenue Per User (ARPU): What's the average amount each customer pays?

Stringing these drivers together creates a logical, defensible revenue forecast. If you're pre-launch, use industry benchmarks and insights from early customer interviews to make educated assumptions. The key is to show your work—investors want to see the logic, not just a big number.

Calculate Your Cost of Goods Sold

Once you have a revenue projection, you must determine the direct costs of delivering your product. This is your Cost of Goods Sold (COGS). These are variable costs that increase as your sales increase.

A classic startup mistake is lumping operating expenses in with COGS. Remember this distinction: COGS are the costs of delivering your product. Operating expenses are the costs of running the business, whether you make a sale or not.

What counts as COGS depends on your business:

- SaaS Startup: Server hosting fees (AWS), third-party software embedded in your product, and salaries for customer support.

- Ecommerce Business: The cost of physical products, shipping expenses, and payment processing fees.

- Service Business: Primarily the salaries of the people directly delivering the service to clients.

Subtracting COGS from revenue gives you your Gross Profit. This metric reveals how profitable your core product is before overhead, providing a crucial signal about your business model's viability.

Forecast Your Operating Expenses

Next up are your Operating Expenses (OpEx). These are the fixed costs required to keep the lights on, regardless of sales volume. This is where you map out the costs of your team and infrastructure.

Break OpEx into three primary buckets:

- Sales & Marketing (S&M): Ad spend, content creation, sales commissions, and marketing team salaries.

- Research & Development (R&D): Salaries for engineers, product managers, and designers involved in building and improving your product.

- General & Administrative (G&A): The overhead category, including office rent, legal fees, accounting services, and executive salaries.

Pro Tip: When forecasting salaries, account for the fully loaded cost. Add payroll taxes, health insurance, and retirement benefits, which can add 20-30% on top of a base salary. Ignoring these "hidden" costs will create a massive hole in your budget. This level of detail shows you have a true handle on the costs of scaling. For a deeper look at building out these projections, our guide on startup financial modeling breaks it down even further.

Assembling the Pieces into a Coherent Model

With revenue, COGS, and OpEx, you have the building blocks for your projected Income Statement. This process forces you to think critically about every assumption driving your business, from marketing conversion rates to your hiring plan, turning a simple spreadsheet into a powerful strategic tool.

Your first forecast won't be perfect. The goal is to create a realistic, dynamic model that you update as you collect real-world data. This document becomes a living roadmap, guiding your decisions and helping you steer your startup with clarity and confidence.

Leveraging Modern Tools For Smarter Forecasting

Relying solely on spreadsheets for financial forecasting is like using a paper map for a cross-country road trip. It’s slow, prone to human error, and useless when conditions change. A single broken formula can send your projections spiraling, leading to poor decisions on hiring, spending, and runway.

Modern financial planning and analysis (FP&A) platforms are the GPS for your business. They automate data aggregation, reduce manual errors, and provide real-time insights that static spreadsheets can't match. This is a fundamental shift toward making agile, informed decisions in a fast-moving market.

Moving From Static Plans To Dynamic Strategy

Modern tools transform your forecast from a rigid annual document into a living strategic asset. Instead of a dreaded quarterly update, you can instantly run "what-if" scenarios to guide daily decisions.

Imagine getting answers to critical questions in minutes, not days:

- What happens to our cash runway if customer churn jumps by 5%?

- What's the bottom-line impact of hiring two new developers next quarter versus waiting six months?

- How does a 10% increase in marketing spend affect our Customer Acquisition Cost?

This capability allows you to be proactive. You can test the financial impact of ideas before you commit capital, turning forecasting from a backward-looking chore into a forward-looking strategic weapon.

The Rise Of AI In Financial Forecasting

Artificial Intelligence (AI) is taking these capabilities to the next level. AI-powered platforms can analyze historical data, identify subtle trends, and generate startlingly accurate predictions. Startups using these tools have reported up to a 20% boost in prediction accuracy and are about 10% more likely to achieve consistent year-over-year revenue growth.

By automatically syncing data from your accounting, sales, and payroll systems, modern tools ensure your forecast is always a perfect reflection of reality. This creates a single source of truth that gets your entire leadership team on the same page.

These platforms present complex data through clean, intuitive visuals, allowing you to track key performance indicators (KPIs) in real-time. To see how powerful this can be, check out our guide on building powerful executive dashboard examples that turn raw numbers into actionable insights.

Choosing The Right Tool For Your Startup

Picking the right platform can feel daunting. The best tool depends on your startup's stage and needs, but every founder should look for a few non-negotiable features.

Here's a simple framework to guide your search:

- Integration Capabilities: Does it seamlessly connect with your existing tech stack, like QuickBooks, HubSpot, and Gusto? Automation saves hours and eliminates data entry errors.

- Scalability: Can the platform grow with you? A tool for a pre-seed company might fail when you need to manage multiple product lines or departmental budgets.

- Ease of Use: Is the interface intuitive for your entire leadership team, not just finance experts? Look for clean dashboards and reports that make sense at a glance.

- Support and Expertise: Does the provider offer more than just software? Access to financial expertise can be as valuable as the tool itself for early-stage startups.

Adopting a modern tool for financial forecasting for startups isn't just about building a better spreadsheet. It's about building a more resilient, data-driven, and strategically agile company.

Common Forecasting Mistakes To Avoid

Building an accurate forecast is as much about avoiding pitfalls as it is about including the right data. Even the sharpest founders can see their plans unravel due to a few common, critical errors.

Think of this as your pre-flight checklist to keep your financial model grounded in reality.

The "Hockey Stick" Fantasy

One of the most frequent mistakes is the "hockey stick" projection—a revenue chart showing a sudden, dramatic upward curve without a clear, bottoms-up reason for the explosive growth.

Investors are immediately skeptical of these. If massive growth isn't directly tied to tangible drivers—like a surge in marketing spend, a growing sales team with proven quotas, or solid conversion rates—it looks like a fantasy. Ambition must be backed by a logical story.

Confusing Profit With Cash

This is a classic startup-killer. A company can be profitable on its income statement yet go bankrupt because it runs out of cash. Profit means nothing if your clients pay in 90 days but payroll is due next week.

Imagine a D2C brand that smashes its revenue goals. But if they didn't accurately model the cash needed upfront for inventory and advertising, they could run dry before customer payments hit the bank. This is why the Cash Flow Statement is the most scrutinized document for any early-stage company; it shows your actual runway.

Your forecast must tell the story of your cash. Profit is an opinion, but cash is a fact. Failing to manage it is one of the top reasons startups fail.

Underestimating Your True Costs

Many founders underestimate what things actually cost, especially people. It's not enough to budget for a base salary; you must account for the fully loaded cost of an employee.

This includes payroll taxes, health insurance, and retirement contributions, which can add 20-30% to a salary. In many fintech companies, personnel costs can make up 60-70% of all expenses. Getting this massive line item wrong will burn through your runway much faster than expected. You can dig deeper into managing expenses in fintech financial models to see just how critical this is.

Avoiding these common errors in financial forecasting for startups demands a disciplined approach that sticks to realistic assumptions and keeps a laser focus on cash. Nailing this builds a reliable roadmap and tremendous credibility with investors, who are trained to spot these red flags.

Elevating Your Strategy With Fractional Leadership

As your startup grows, so does the complexity of your financial forecasting. The simple spreadsheet that worked in the early days quickly becomes unmanageable. It demands sophisticated modeling, careful investor relations, and tight internal controls—a full-time job that pulls you away from leading your company.

This strategic turning point is when bringing in a Fractional CFO can be a game-changer. Instead of committing to the hefty salary of a full-time executive, you get access to seasoned financial leadership on a part-time basis. It's the perfect way to level up your financial strategy without blowing up your budget.

Beyond The Spreadsheet: The Strategic Impact

A true financial leader does much more than just "manage the books." A top-tier Fractional CFO elevates your approach to financial forecasting for startups, pushing for tangible results.

They bring crucial expertise to the table by:

- Refining Your Financial Model: Transforming your basic forecast into a dynamic tool that holds up under the toughest investor scrutiny.

- Building Sophisticated Scenarios: Creating detailed "what-if" analyses that prepare you for market shifts, fundraising outcomes, and critical strategic pivots.

- Implementing Robust Controls: Establishing the financial discipline and processes needed for sustainable growth and audit-readiness.

This is a strategic investment in your startup's future. The right person can be a deciding factor in closing your next funding round and navigating the path to profitability. The benefits are massive, and you can dive deeper into the core advantages of fractional leadership for companies on the rise.

Think of a Fractional CFO as an expert navigator for your scale-up journey. While you steer the ship, they provide the advanced charts and deep sea knowledge to avoid hazards and find the fastest route to your destination.

Adding this level of strategic insight to your team is a decisive move. If you're ready to bring a seasoned financial mind to your leadership table, we can connect you with vetted fractional executives who specialize in transforming startups just like yours.

Your Top Questions, Answered

Even with the best plan, founders often have lingering questions about financial forecasting. Let's tackle the most common ones.

How Often Should I Update My Startup's Financial Forecast?

Your forecast is a living document, not a static one. For most early-stage startups, a monthly review is the right cadence. This rhythm allows you to compare your plan to actual results, identify what's working, and adjust your strategy accordingly.

During critical moments—like a fundraising round or a major product launch—tighten that cycle to a weekly review. This provides a closer watch on your cash runway and burn rate when every day counts.

What’s The Difference Between A Bottoms-Up And A Top-Down Forecast?

This distinction is crucial to investors.

- Top-Down Forecasting: Starts with a large market size and claims a small percentage (e.g., "The global market is $1 billion, and we'll capture 1%"). It’s often viewed as speculative.

- Bottoms-Up Forecasting: Is built from the ground up using tangible drivers you control, like website traffic, sales quotas, or conversion rates. It’s rooted in your operational reality.

Investors will almost always demand a bottoms-up forecast because it proves you have a deep, practical understanding of how your business engine works.

What Do Investors Really Look For In A Financial Forecast?

Investors focus on two primary things: the logic behind your assumptions and your cash flow. They need to believe that your revenue goals are tied to concrete, real-world activities, not just wishful thinking.

Above all, they will pore over your cash flow statement to understand your burn rate and runway. A clear, believable picture of how long you can operate before needing more capital is non-negotiable for building investor confidence.

Managing a forecast can quickly become a complex, high-stakes job. If you're ready to bring executive-level expertise into your financial strategy, Shiny connects you with a marketplace of vetted fractional leaders. They can help you build the models and generate the insights you need to scale with confidence. Schedule a consultation to find the right expert for your team.

Article created using Outrank