Fractional Chief Financial Officer Hiring Guide

Understanding The Fractional CFO Model

The fractional Chief Financial Officer (CFO) model offers a fresh approach to financial leadership. Instead of the commitment of a full-time CFO, businesses access high-level expertise on a part-time or project basis. This allows for strategic financial guidance specifically designed for a company’s individual needs. This adaptable structure is especially appealing to startups and small to medium-sized businesses.

How Does The Fractional CFO Model Work?

Fractional CFOs offer a variety of engagement models, changing and adapting as the businesses they work with grow and evolve. This makes the model highly versatile. A startup might initially hire a fractional CFO for a specific project, such as securing funding or developing a financial model.

As the company expands, this short-term engagement can evolve into a long-term partnership. This provides ongoing assistance with financial planning, in-depth analysis, and strategic decision-making. This inherent scalability gives businesses the exact level of expertise they require at every stage. You may find this resource helpful: How to master Fractional Leadership.

Benefits of The Fractional CFO Model

There are several key advantages to the fractional CFO model. Cost savings are significant compared to hiring a full-time CFO. This is because businesses avoid the expenses associated with salary, benefits, and overhead. They also gain access to a seasoned financial expert with a wealth of experience across multiple sectors.

This diverse background can bring invaluable perspectives and new solutions to financial obstacles. Fractional CFOs provide unbiased advice, unaffected by internal company dynamics. This leads to more objective recommendations focused on growth and higher profitability. Demand for fractional CFOs is also increasing. One year saw a dramatic 103% rise in the hiring of interim CFOs. This demonstrates a growing preference for adaptable and budget-friendly financial leadership, particularly within small to mid-sized companies.

Fractional vs. Traditional CFOs

While both fractional and traditional CFOs provide important financial leadership, their approaches differ. A traditional CFO is a full-time employee deeply involved in the daily operations of one company. A fractional CFO, on the other hand, works with multiple clients.

This offers them a broader perspective and a wider range of experience. By applying best practices and strategies from across various industries, they offer a unique advantage. This breadth of experience can be highly beneficial for businesses aiming to expand and navigate changing market conditions. A fractional CFO can often bring a more diverse skillset than a traditional CFO specializing in a single sector.

Recognizing When You Need Fractional Financial Leadership

Integrating a fractional Chief Financial Officer (CFO) requires careful timing. This section explores the key indicators suggesting it’s time to bolster your financial leadership. Recognizing these signs early can prevent financial mismanagement from impacting your company’s growth.

Indicators of the Need For a Fractional CFO

Several factors indicate your business might benefit from the expertise of a fractional CFO. Rapid growth, for instance, can easily overstretch existing financial systems. This often results in difficulties with accurate financial reporting, forecasting, and effective cash flow management.

Raising capital, particularly during complex funding rounds, requires specialized financial knowledge. A fractional CFO can expertly navigate these intricate processes. Beyond fundraising, a fractional CFO provides invaluable support when preparing for a merger or acquisition, navigating a restructuring, or simply aiming to enhance profitability.

-

Rapid Growth Outpacing Current Systems: This commonly causes inaccurate reporting and difficulty managing cash flow.

-

Complex Funding Rounds: Securing capital requires specialized knowledge and a strategic financial approach.

-

Mergers & Acquisitions: Navigating these complex transactions requires expertise in valuation and deal structuring.

-

Financial Restructuring: A fractional CFO can guide your company through challenging financial periods and develop recovery plans.

-

Desire for Improved Profitability: Analyzing financial data and implementing cost-saving measures can significantly improve your bottom line.

How Different Business Stages Benefit

Different stages of a company’s lifecycle benefit uniquely from fractional CFO services. Startups, for example, can leverage fractional CFOs to build a solid financial foundation. This includes establishing accounting systems, defining key performance indicators (KPIs), and creating financial projections for potential investors.

The focus evolves as businesses mature. A fractional CFO can assist scaling companies in developing advanced financial models for growth, optimizing pricing strategies, and securing necessary funding to support expansion. Even established companies can benefit, potentially requiring support with strategic planning, cost reduction initiatives, or succession planning.

Addressing Specific Financial Challenges

Fractional CFOs are adept at tackling specific financial challenges. They can analyze current financial performance to pinpoint areas for improvement, helping optimize pricing models, manage cash flow more effectively, and enhance overall profitability.

Furthermore, they can implement robust financial controls and systems to ensure accurate reporting and mitigate risk. This is particularly important for businesses seeking external funding or preparing for a potential exit.

Recognizing the ROI of a Fractional CFO

Understanding when a fractional CFO will deliver the highest return on investment is essential. If your financial processes are hindering growth, you’re struggling to secure funding, or lack the internal expertise to manage complex financial issues, it’s a strong indicator. Consider a fractional CFO a strategic investment. Their guidance can lead to improved financial performance, increased valuation, and a more robust position for future success. Recognizing the need for a fractional CFO is ultimately about recognizing the potential for substantial growth and sustained financial health.

Smart Financial Comparison: Full-Time vs. Fractional CFO

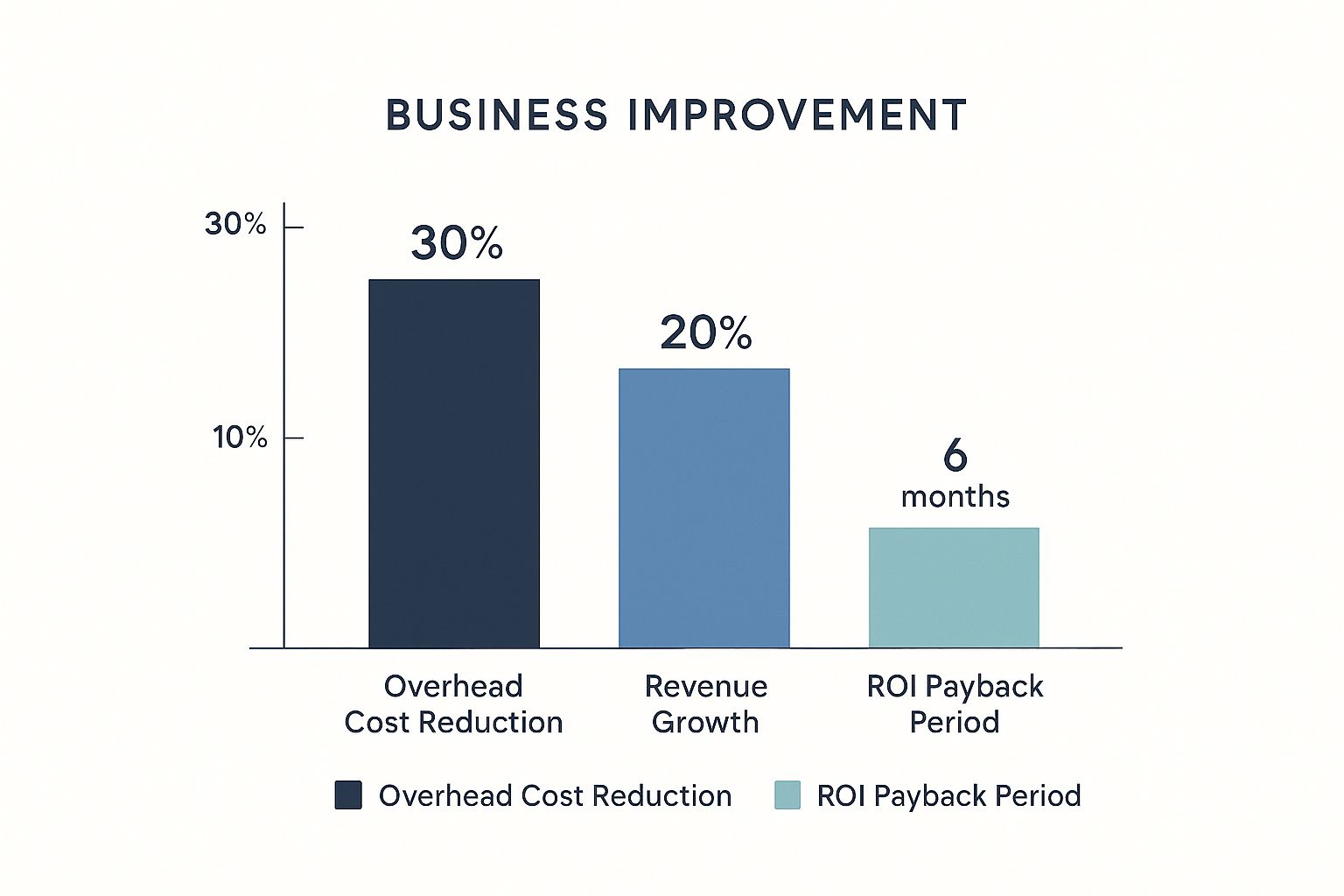

This infographic highlights the financial impact of choosing a fractional CFO compared to a full-time CFO. It focuses on three key areas: overhead cost reduction, revenue growth, and ROI payback period. A fractional CFO can lead to a 30% reduction in overhead, a 20% boost in revenue growth, and an ROI payback period of only six months.

These compelling statistics showcase the significant advantages of using a fractional CFO. It’s a smart strategy to improve financial performance without the high cost of a full-time executive.

Evaluating The True Cost: A Comprehensive Perspective

When comparing the costs of a full-time versus fractional Chief Financial Officer, it’s important to consider more than just salary. A full-time CFO’s total cost includes benefits like health insurance, retirement contributions, paid time off, and bonuses.

There are also indirect costs such as recruitment fees, office space, and the time spent on hiring and management. A full-time CFO can cost a business over $200,000 per year, plus the added expenses of benefits and bonuses.

Fractional CFOs offer expert financial knowledge at a much lower cost. This makes them a financially sound choice for startups and small businesses.

Pricing Models and Value Assessment For Fractional CFOs

Fractional CFOs use various pricing models. Some charge by the hour, while others use project-based fees or retainers for ongoing services. Understanding these models is essential for determining value.

An hourly rate may work well for short-term, defined projects. A retainer arrangement can offer more predictable costs and continuous strategic advice for longer engagements.

To help illustrate the cost differences, let’s take a look at a detailed comparison:

This table summarizes the potential annual cost savings and value proposition of hiring a fractional CFO compared to a full-time CFO.

| Cost Category | Full-Time CFO | Fractional CFO | Annual Savings |

|---|---|---|---|

| Base Salary | $200,000 | $50,000 – $100,000 | $100,000 – $150,000 |

| Benefits (Health Insurance, Retirement) | $25,000 | Variable, often lower | $10,000 – $25,000 |

| Bonuses | $20,000 | Typically none | $20,000 |

| Recruiting Fees | $10,000 (one-time, amortized over several years) | Minimal | $2,000 – $10,000 |

| Total Annual Cost | $255,000 + | $60,000 – $110,000 | $145,000+ |

As shown in the table, the potential savings are substantial. This allows businesses to reinvest these savings into other critical areas like marketing or product development.

Calculating the ROI of Your Fractional CFO Investment

Calculating the return on investment (ROI) of a fractional CFO involves more than just comparing costs. You also need to assess their influence on key financial indicators. Consider how their advice has improved cash flow, helped secure funding, or impacted revenue and expenses.

These are vital questions to consider when evaluating the true value of a fractional CFO.

Strategic Financial Leadership Without The Full-Time Price Tag

The value of a fractional CFO extends beyond cost savings. Their strategic guidance, diverse experience, and focused problem-solving can greatly improve a company’s financial health. By carefully considering your needs and understanding pricing models, your business can make informed choices about leveraging the advantages of fractional financial leadership.

Essential Services Your Fractional CFO Should Provide

A fractional Chief Financial Officer (CFO) offers a range of services to improve a company’s financial well-being. Understanding these services is key to maximizing their impact. This section explores the core services a fractional CFO provides, from overarching strategy to practical financial management.

Strategic Financial Planning and Analysis

This involves charting a course for your company’s financial future. Your fractional CFO should excel at building financial models for growth, performing comprehensive financial analysis, and offering strategic advice based on data insights. This proactive approach helps businesses anticipate and address challenges, as well as capitalize on opportunities.

For instance, they might analyze market trends and develop financial projections to inform expansion plans or new product development. This forward-thinking approach ensures your business is prepared for the future.

Cash Flow Optimization

Healthy cash flow is crucial for any business. A fractional CFO can introduce strategies to improve cash flow management. These might include optimizing accounts receivable and payable processes, negotiating better payment terms with vendors, and implementing efficient inventory management systems.

This ensures your business has the necessary funds for operations and future investments. By managing cash flow effectively, your business can maintain stability and pursue growth opportunities.

Fundraising Support

Raising capital can be a complicated endeavor. A fractional CFO can be invaluable, assisting with preparing financial projections for investors, negotiating favorable financing terms, and navigating the intricacies of different funding rounds.

Their experience can simplify the fundraising process and improve your chances of securing the necessary capital. This expert guidance can be the key to unlocking growth and achieving your business objectives.

Financial System Implementation and Management

Robust financial systems are essential for any successful business. Your fractional CFO should be proficient in implementing and managing these systems, including accounting software like QuickBooks, reporting tools like Tableau, and internal control procedures.

This ensures the accuracy and reliability of your financial data, providing a solid base for informed decision-making. Accurate data allows you to understand your financial position clearly and make strategic choices.

Other Key Services Your Fractional CFO Can Provide

Beyond these core services, a fractional CFO often handles other important tasks, such as:

- Budgeting and Forecasting: Developing detailed budgets and forecasts to guide spending and track financial performance.

- Financial Reporting: Preparing regular financial reports to monitor key performance indicators (KPIs) and inform stakeholders about the company’s financial health.

- Investor Relations Management: Communicating with investors, providing performance updates, and addressing investor inquiries.

- Merger and Acquisition Support: Providing financial due diligence, valuation analysis, and deal structuring advice during mergers and acquisitions.

- Regulatory Compliance: Ensuring the company adheres to all applicable financial regulations and reporting requirements.

Read also: Explore a more detailed overview of fractional CFO services. This allows you to focus on your core business while your fractional CFO manages your financial infrastructure.

Prioritizing Services Based on Business Stage

The services you prioritize from your fractional CFO should align with your company’s specific needs and growth stage. A startup might concentrate on building robust financial systems and securing seed funding.

A rapidly expanding business might prioritize cash flow optimization and financial modeling for expansion. Established companies might engage a fractional CFO for strategic planning and succession planning. Understanding these varied needs helps maximize the value of your fractional CFO. The ultimate goal is to find a fractional CFO who can adapt to your evolving needs and support your long-term success.

Finding And Hiring Your Perfect Fractional CFO Match

Success with a fractional Chief Financial Officer (CFO) begins with finding the right fit. This means identifying candidates with the precise skills and experience to tackle your company’s unique challenges and contribute to your overall goals. This involves a thoughtful evaluation process, weighing technical expertise against how well they mesh with your company culture.

Choosing the right fractional CFO sets the stage for a successful partnership, allowing you to leverage financial expertise without the commitment of a full-time hire. This strategic approach to financial leadership can be a game-changer for businesses of all sizes.

Defining Your Needs and Objectives

Before you begin your search, clearly define your needs and objectives. What financial hurdles are you facing? What strategic goals are you aiming for? A clear understanding of your company’s needs will help you determine the ideal skillset and experience level for your fractional CFO.

For instance, a rapidly expanding startup might need a fractional CFO specializing in fundraising and financial modeling. A more established company, on the other hand, might prioritize strategic planning and cost optimization.

Sourcing Potential Candidates

Once you know what you’re looking for, begin sourcing potential candidates. Networking within your industry can often uncover valuable referrals. Online platforms, like Shiny, a fractional executive marketplace, can also be extremely helpful. These platforms specialize in connecting businesses with seasoned professionals and often pre-vet candidates, saving you valuable time and resources.

By leveraging a combination of networking and online resources, you can efficiently identify and connect with qualified fractional CFO candidates. This targeted approach can significantly streamline the hiring process.

Evaluating Candidates: Key Questions and Criteria

When evaluating potential candidates, focus on their experience with comparable companies and industries. Scrutinize their track record in achieving specific financial outcomes. For example, inquire about how they’ve helped other companies boost cash flow, secure funding, or navigate financial restructuring. Understanding their past successes can give you valuable insight into their potential contributions to your business.

To help organize your evaluation process, here’s a table outlining essential criteria:

Before diving into interviews, take a moment to review this table. It will help you focus your questions and assess candidates effectively.

| Evaluation Area | Key Criteria | Questions to Ask | Weight |

|---|---|---|---|

| Experience | Industry-specific experience, Proven track record of success | “Tell me about a time you helped a company in our industry overcome a similar financial challenge.” | High |

| Skills | Financial modeling, forecasting, budgeting, strategic planning | “What is your approach to developing financial projections for a rapidly growing company?” | High |

| Communication | Clear and concise communication, Ability to explain complex financial information clearly | “How would you explain complex financial data to non-financial stakeholders?” | Medium |

| Cultural Fit | Alignment with company values, Personality fit with the team | “Describe your preferred working style and company culture.” | Medium |

This table summarizes the key areas to focus on during your candidate evaluation. By weighting these factors appropriately, you can ensure a well-rounded assessment.

For startups, you might find this resource particularly helpful: Learn more about finding the right fractional CFO for your startup.

Structuring the Engagement and Setting Expectations

Once you’ve chosen your fractional CFO, clearly outline the scope of their work, their reporting structure, and the expected deliverables. Setting these parameters upfront ensures alignment and sets the stage for a productive partnership.

Establishing clear metrics for measuring performance and regular communication channels is equally important. Open communication and regular feedback are crucial for a successful collaboration.

Ongoing Management and Performance Measurement

Regularly assess the performance of your fractional CFO against the pre-determined metrics. Provide constructive feedback and adapt the engagement as needed. This ensures you’re maximizing the value of their expertise and that their efforts remain aligned with your evolving business requirements.

By actively managing the relationship and staying adaptable, you can optimize the impact of your fractional CFO and achieve your desired financial outcomes.

Maximizing Returns From Your Fractional CFO Partnership

A successful fractional CFO partnership hinges on strategic planning and transparent communication. Implementing best practices from the start maximizes your return on investment and fuels business growth. This involves a well-structured onboarding process, clear expectations, and integrated workflows.

Effective Onboarding of Your Fractional CFO

Effective onboarding sets the stage for a productive partnership. Begin by providing a comprehensive business overview. Include its history, current financials, short-term objectives, and long-term vision. This initial deep dive allows the CFO to quickly understand your unique challenges and opportunities.

Clearly defined roles and responsibilities, coupled with established communication channels, contribute to seamless integration. This proactive approach ensures initial alignment, minimizing potential misunderstandings and maximizing efficiency.

Setting Realistic Expectations and Driving Results

Clearly defined goals and Key Performance Indicators (KPIs) are crucial for measuring the success of your fractional CFO engagement. These should align with your overall business objectives.

For example, if your goal is Series A funding, KPIs might include:

- Developing a robust financial model

- Preparing a compelling investor pitch deck

- Identifying potential investors

Regularly reviewing progress against these KPIs keeps the engagement focused and results-oriented, providing opportunities for adjustments as needed.

Creating Workflows That Maximize Impact

Integrate your fractional CFO into existing workflows to maximize their impact across your business. This involves providing access to necessary financial data, systems, and key personnel.

For instance, if optimizing cash flow is the task, they’ll need access to your accounting software and the ability to collaborate with your accounts payable and receivable teams. Clear communication protocols ensure the CFO’s expertise is leveraged effectively to address financial challenges and support informed decision-making.

Learning From Success Stories and Case Studies

Examining case studies and lessons learned from other businesses that have utilized fractional CFOs offers valuable insights. One company might have improved profitability through cost-saving measures recommended by their CFO. Another might have successfully navigated a complex acquisition with their CFO’s guidance. These real-world examples offer practical strategies and highlight potential pitfalls.

Measuring Success, Making Adjustments, and Transitioning

Regularly evaluate the impact of your fractional CFO partnership against predetermined metrics. This ongoing assessment provides opportunities for adjustments and ensures alignment with your evolving needs.

As your business grows, the initial scope of work might need to be expanded or refined. This adaptability is a key advantage of the fractional CFO model. Eventually, a full-time CFO might become necessary. Recognizing this transition point and planning a smooth handover ensures continued financial leadership.

Achieving Your Financial Goals With The Right Partnership

By implementing these best practices, you can unlock the full potential of your fractional CFO partnership. This strategic approach to financial leadership empowers your business to achieve its objectives, from securing funding to improving profitability and navigating complex financial challenges.

Ready to experience the benefits? Shiny offers a network of over 650 vetted executives, including experienced fractional CFOs across various industries. Connect with a fractional CFO through Shiny today and discover how their expertise can benefit your business.