Drive Success: Interim Chief Financial Officer

Why Organizations Are Flocking to Interim CFOs

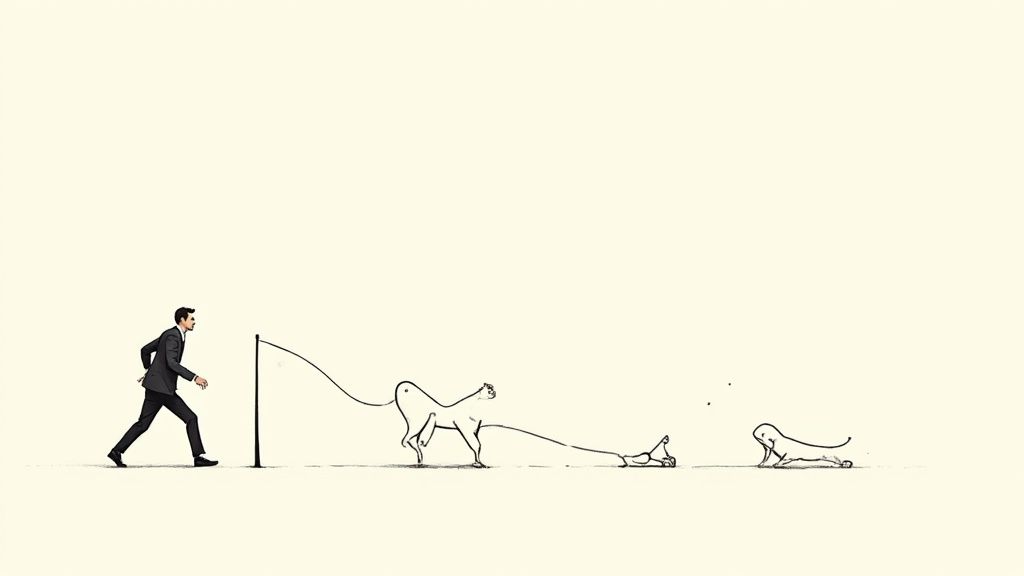

The financial leadership landscape is changing. More and more, organizations are recognizing the advantages of interim Chief Financial Officers (CFOs). These temporary leaders offer valuable support to businesses navigating a range of challenges and opportunities.

The Rise of On-Demand Financial Expertise

Today’s business environment demands a high level of financial management. Companies must adapt to evolving regulations, new technologies, and economic fluctuations. An interim CFO offers specialized knowledge and experience to meet these challenges head-on.

Unlike a permanent hire, an interim CFO provides short-term support. This allows companies to access top-tier financial talent precisely when they need it. The demand reflects this need. Interim CFO requests grew by a staggering 46% in 2023 compared to the previous year, according to a Business Talent Group (BTG) report. This increase underlines the difficulty many businesses face in filling these crucial roles due to talent shortages and high turnover.

Bridging the Gap During Transitions

Periods of transition, like mergers, acquisitions, or leadership changes, create instability. An interim CFO provides essential guidance and maintains continuity during such uncertain times. They can also prepare the organization for a permanent CFO.

By establishing robust processes, improving financial reporting, and building a strong financial foundation, an interim CFO paves the way for a smoother handover. This minimizes disruptions and allows the incoming CFO to hit the ground running. For more on interim leadership, see this article on Interim Executive Solutions.

Accessing Specialized Skills

Interim CFOs often possess highly specialized skills not readily found within the organization. They might be engaged to manage a specific project, such as an Initial Public Offering (IPO), a complex system implementation, or a financial turnaround.

This targeted expertise can dramatically accelerate project timelines and deliver significant value quickly. A permanent CFO, with their broader responsibilities, may not have the bandwidth or specific expertise to focus so intensely on a single project. An interim CFO’s focused approach maximizes the return on investment for these critical initiatives.

What Exceptional Interim CFOs Deliver

Exceptional interim CFOs offer more than just maintaining the current state of affairs. They possess a valuable combination of experience and specialized expertise to facilitate significant positive change within organizations. These financial leaders serve as crucial agents of change, addressing immediate needs while simultaneously building a framework for long-term financial stability and success.

Balancing Immediate Needs With Long-Term Vision

A key characteristic of a highly effective interim chief financial officer is the ability to balance urgent requirements with a long-term strategic vision. For instance, they might be brought in to stabilize finances during a leadership transition. At the same time, they can also develop strategies to enhance financial reporting and internal controls for the future.

This two-pronged approach ensures short-term stability while paving the way for sustained growth.

Interim CFOs also frequently play a vital role in managing specific projects. They might oversee a merger or acquisition, implement a new financial system like NetSuite, or guide a company through a period of rapid expansion. This project-focused engagement model allows them to apply their specialized skills to achieve targeted objectives, delivering immediate value to the organization.

The following table outlines the core responsibilities of an interim CFO, highlighting the specific tasks involved and their strategic impact on the business.

To understand the wide range of duties an interim CFO handles, let’s take a closer look at the typical responsibilities assigned to them. The table below provides a breakdown of the primary duties and responsibilities typically assigned to interim chief financial officers during their engagements:

| Responsibility Area | Specific Tasks | Strategic Impact |

|---|---|---|

| Stabilizing Finances | Cash flow management, debt restructuring, cost reduction initiatives | Ensures short-term financial stability and creates a foundation for future growth |

| Leading Transformations | Guiding mergers and acquisitions, implementing new financial systems, overseeing restructuring efforts | Drives significant organizational change and positions the company for long-term success |

| Managing Finance Operations | Overseeing daily financial activities, ensuring accurate reporting, implementing effective controls | Maintains efficient and compliant financial processes, providing reliable financial data for decision-making |

| Conducting Analysis & Budgeting | Performing cost-benefit analyses, developing annual budgets, forecasting future financial performance | Provides critical insights for resource allocation and strategic planning |

As the table illustrates, the interim CFO wears many hats, contributing to both immediate needs and long-term strategies. In 2022, finance positions made up nearly half of all interim requests received by executive search firms. This highlights the critical role these leaders play in ensuring business continuity and strategic alignment within a company’s financial operations.

Driving Strategic Initiatives

Beyond managing daily financial operations, exceptional interim CFOs make substantial contributions to strategic initiatives. They have the experience and analytical skills to examine financial data, identify areas for improvement, and develop action plans to achieve strategic business goals.

This forward-thinking approach empowers organizations not just to survive challenges but to thrive and capitalize on opportunities.

These interim leaders also often serve as valuable advisors to the CEO and other senior executives. They can offer objective insights on financial matters, helping to guide strategic decision-making and ensure alignment between financial goals and overall business objectives. This strategic guidance is particularly crucial during times of change or uncertainty.

Building a Strong Foundation

Top interim CFOs recognize that their role extends beyond short-term solutions. They prioritize building a robust financial framework that will support the organization’s long-term success. This involves implementing sound financial processes, improving the accuracy of financial reporting, and establishing effective internal controls to minimize risks.

By strengthening the core financial infrastructure, they leave a lasting positive impact that extends well beyond their tenure.

Perfect Timing: When to Bring in an Interim CFO

Knowing when to engage an interim Chief Financial Officer (CFO) is a strategic decision. It’s about bringing in specialized expertise at the right moment to achieve specific business goals. Timing is key. It’s not just about filling a temporary gap.

Identifying the Need for Interim Financial Leadership

Several scenarios often indicate the need for interim financial leadership. The sudden departure of a permanent CFO is a common trigger. This can leave a significant leadership void, especially during critical periods. An interim CFO provides much-needed stability, maintaining financial operations until a permanent replacement is secured.

Rapid growth can also necessitate an interim CFO. Expanding businesses often outgrow their existing financial systems and processes. An interim CFO can help establish the necessary controls and infrastructure to manage increased financial complexity. Similarly, companies preparing for an Initial Public Offering (IPO) often require a specific skillset. An interim CFO with IPO experience can be invaluable in navigating complex regulatory requirements. This targeted support ensures a smooth transition and positions the company for a successful IPO.

Specific Situations Where an Interim CFO Excels

Mergers and acquisitions (M&A) present unique financial hurdles. An interim CFO with M&A experience can be instrumental in facilitating the integration process, ensuring a seamless transition. This is particularly beneficial for businesses that lack in-house M&A expertise. Financial turnarounds are another area where interim CFOs shine. When a company encounters financial distress, an interim CFO provides objective expertise to stabilize the situation, developing and implementing restructuring plans, enhancing cash flow management, and negotiating with creditors.

Systems implementations also benefit from the guidance of an interim CFO. Implementing a new Enterprise Resource Planning (ERP) system, for instance, requires significant financial oversight. An interim CFO can steer the implementation, aligning it with the company’s financial objectives. This is often far more efficient and cost-effective than relying solely on internal resources.

Different Contexts, Different Needs

The timing and scope of an interim CFO engagement will vary. Startups often engage interim CFOs to build their initial financial framework. This allows founders to concentrate on product development and market expansion. Established companies may engage an interim CFO for specific projects, such as overseeing a divestiture or implementing new financial software. The business’s specific requirements dictate the engagement’s parameters. Industry also plays a factor. Highly regulated industries may require an interim CFO with specific compliance experience.

Choosing an interim CFO isn’t a one-size-fits-all solution. It demands careful consideration of the company’s unique situation and industry. For companies seeking fractional CFO support, Shiny offers a fractional CFO marketplace that connects startups with experienced financial professionals.

The New Era of On-Demand Financial Leadership

The business world is experiencing a significant shift in how companies approach financial leadership. The traditional, permanent CFO role is evolving, making way for a more flexible solution: the interim Chief Financial Officer. This model provides businesses with access to specialized financial expertise precisely when they need it, offering a competitive edge in today’s ever-changing marketplace.

The Rise of Agile Talent Strategies

This move toward on-demand financial leadership represents a major departure from conventional hiring practices. Companies are increasingly recognizing the value and flexibility of interim CFOs, especially during periods of transition or transformation. This reflects a larger trend toward agile talent strategies, enabling organizations to quickly respond to market fluctuations and capitalize on emerging opportunities.

For instance, a startup preparing for an IPO might require specialized financial guidance for a specific timeframe. An interim CFO with proven IPO experience can expertly steer the company through the process without a long-term commitment. Similarly, established companies navigating mergers or acquisitions can benefit from the insights of an interim CFO to manage the complexities of financial integration.

Several factors are driving this shift. The increasing complexity of financial regulations, the rapid pace of technological change, and the ongoing challenge of finding and retaining skilled talent all contribute to the growing need for specialized, on-demand expertise.

Moreover, the market for on-demand talent, including interim CFOs, has seen impressive growth. Since 2022, there has been a 170% surge in requests for on-demand leadership roles, including those in finance. For more detailed insights, check out this article from Fortune.

Democratizing Access to World-Class Expertise

The increasing prevalence of interim CFOs is democratizing access to top-tier financial talent for businesses of all sizes. Specialized platforms like Shiny connect businesses with highly experienced interim CFOs, simplifying the process of securing high-quality financial leadership. This increased access empowers smaller businesses and startups to compete more effectively with larger corporations, creating a more level playing field. The professionalization of interim services further enhances this accessibility, ensuring high standards and ethical practices.

Flexibility and Competitive Advantage

This new era of on-demand financial leadership provides businesses with unprecedented flexibility. Companies can engage specialized financial expertise precisely when and for the duration they require it, avoiding the substantial costs and long-term commitments of permanent hires. This ability to scale financial leadership up or down according to project requirements creates a significant competitive advantage. By adapting quickly to changing market dynamics and accessing specialized talent on demand, businesses are better positioned for sustained growth and overall success.

Finding Your Financial Compass: Selecting the Ideal Interim CFO

Identifying the perfect interim chief financial officer (CFO) requires a different approach than filling a permanent position. It demands a more focused and strategic process, one that carefully considers the specific needs of your organization and the unique nature of an interim role.

Key Qualifications Beyond the Resume

While a polished resume is essential, choosing an interim CFO requires looking beyond the typical qualifications. Experience navigating specific situations, like turnarounds or periods of rapid growth, is paramount. An interim CFO with a proven track record of success in similar scenarios brings valuable experience and is more likely to deliver results quickly.

For instance, if your company is preparing for an initial public offering (IPO), an interim CFO with demonstrated IPO experience is invaluable. Their specialized knowledge can significantly simplify the process. This targeted approach to experience evaluation is far more effective than solely focusing on years served in a CFO role.

Essential Soft Skills for Interim Success

Soft skills are just as critical as technical expertise for interim CFOs. Adaptability is paramount, enabling them to seamlessly integrate into a new environment and effectively collaborate with existing teams. Strong communication skills are also essential for clearly articulating financial strategies and building trust with stakeholders. Finally, decisiveness is key. Interim CFOs often face time-sensitive situations requiring swift, informed decision-making.

Industry-Specific Expertise

The ideal interim CFO should possess industry-specific knowledge. A deep understanding of your industry’s financial nuances, regulatory environment, and competitive landscape can substantially impact their effectiveness. An interim CFO with experience in the healthcare industry, for example, will have a different perspective and skillset compared to one with a background in technology. This specialized knowledge enables them to quickly grasp the unique challenges and opportunities facing your business. Consider exploring platforms like Shiny’s fractional CFO marketplace to connect with experienced financial professionals for startups.

Specialized Interviewing Techniques

Interviewing an interim CFO necessitates a tailored approach. Focus on questions that uncover their ability to thrive in temporary assignments. Inquire about their experience adapting to new environments, managing rapid change, and making decisive choices under pressure. Ask for specific examples of how they successfully navigated challenging situations in previous interim roles. This method offers valuable insights into their problem-solving skills and adaptability.

Evaluating Cultural Alignment

Even for temporary engagements, cultural fit matters. Seek candidates whose work style and values align with your organizational culture. This fosters a more productive and collaborative working relationship. While a perfect match may not always be feasible for an interim role, prioritizing compatibility significantly enhances the overall experience.

Leveraging Specialized Talent Platforms

Specialized talent platforms and executive search firms are invaluable for locating qualified interim CFOs. These platforms provide access to a network of pre-vetted, experienced professionals, streamlining the search process. They also offer valuable assistance in matching your specific requirements with the appropriate candidate expertise.

Comparing Selection Criteria

Selecting the right interim CFO hinges on your company’s specific circumstances. Different situations necessitate different skillsets and experiences. The following table, “Interim CFO Selection Criteria Comparison,” outlines key selection criteria for various scenarios, offering a comparison of key factors to consider when evaluating potential interim chief financial officer candidates for different organizational scenarios:

| Selection Criteria | Turnaround Situation | Growth Phase | System Implementation | Pre-Transaction |

|---|---|---|---|---|

| Experience | Restructuring, cost reduction | Financial planning, fundraising | Project management, technical expertise | Due diligence, financial modeling |

| Soft Skills | Decisiveness, resilience | Communication, collaboration | Adaptability, problem-solving | Analytical skills, attention to detail |

| Industry Expertise | Relevant industry experience | Understanding of growth markets | Software implementation experience | M&A experience |

This comparison highlights how critical experience, necessary soft skills, and relevant industry knowledge shift based on the organization’s immediate needs. For instance, a turnaround situation prioritizes decisiveness and restructuring experience, whereas a growth phase emphasizes communication and fundraising expertise.

By carefully evaluating these factors, you can select an interim CFO well-prepared to address your organization’s unique challenges and drive favorable results.

Maximizing ROI From Your Interim CFO Partnership

The true value of an interim Chief Financial Officer engagement depends on effective relationship management. This involves careful planning, clear communication, and a collaborative approach. Ensure both parties are aligned on objectives and expectations to maximize the impact of your investment in temporary financial leadership.

Onboarding for Success

A strong onboarding experience sets the stage for a productive interim CFO partnership. Provide comprehensive access to crucial information, including financial statements, budgets, and current processes. Introduce the interim CFO to key stakeholders and explain the organizational culture.

Establish regular communication, whether daily or weekly check-ins. Discuss progress, address challenges, and maintain alignment on strategic objectives. Consistent communication keeps everyone informed and integrates the interim CFO into the team.

Defining Clear Objectives and Measurable Outcomes

Just as with a permanent CFO, define measurable outcomes for the interim CFO. These objectives should adhere to the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, implementing a new budgeting system within three months or reducing operational expenses by 10% within six months.

These objectives should address the reasons for engaging the interim CFO, such as navigating a financial turnaround, preparing for an IPO, or managing an M&A. Clarity ensures focused and impactful efforts.

Facilitating Seamless Knowledge Transfer

Knowledge transfer ensures long-term benefits from the interim CFO engagement. Document key processes, decisions, and recommendations. This creates a valuable knowledge base for the incoming CFO or other team members after the interim CFO departs.

For example, if the interim CFO develops new financial models, document the assumptions and methodology. This proactive approach maximizes the long-term ROI. You might be interested in: CFO services for startups.

Empowering and Maintaining Governance

Effective partnerships balance empowerment with governance. Provide the interim CFO with the authority to make necessary decisions. Simultaneously, maintain reporting and accountability. Regular updates to the CEO or board of directors ensure transparency and allow for timely adjustments.

Managing Stakeholder Expectations

Open communication with employees, investors, and board members manages expectations and builds confidence. Clearly define the interim CFO’s role, responsibilities, and engagement duration. This transparency ensures everyone is aligned.

Preparing for a Smooth Transition

Planning for the transition to permanent leadership is crucial. Define the handover process, document accomplishments and ongoing projects, and ensure seamless knowledge transfer to the incoming CFO. This minimizes disruption and maintains smooth financial operations.

By implementing these strategies, organizations can unlock the full potential of an interim CFO partnership and positively impact their financial trajectory.

Ready to scale your startup with top-tier executive talent? Explore Shiny’s fractional executive marketplace at https://useshiny.com/ and discover how our flexible solutions can drive growth.