Startup Valuation Methods: A Founder’s Guide to Valuing Your Company

Startup valuation methods are the financial models you use to put a price tag on your company. Figuring out what your startup is worth is essential for fundraising, potential mergers, and even for handing out employee stock options.

The right method depends on your journey—whether you're a pre-revenue idea or a profitable business. Understanding these models is the first step toward striking a fair deal and building a financial story that investors can believe in.

Why Your Startup Valuation Is More Than Just a Number

For a founder, your startup's valuation isn't just an abstract metric; it's the narrative of your company's future potential, wrapped up in a single number. This figure dictates how much equity you give away for an investment, defines your bargaining power, and sets the stage for every funding round to come.

Think of it like pricing a one-of-a-kind piece of art. Price it too low, and you leave value on the table. Price it too high, and you could scare off the very investors you need.

A credible, well-reasoned valuation sends a powerful signal. It shows you’re a professional who understands your company's place in the world. To get even deeper into these core financial concepts, you can also learn more about enterprise value in our detailed guide.

The Strategic Importance of an Accurate Valuation

Nailing your valuation has a ripple effect across your business, from hiring key employees to long-term strategic planning. A valuation backed by solid reasoning is a powerful tool for building momentum and credibility.

Here are the key areas directly impacted:

- Fundraising: A realistic valuation is the bedrock of any successful funding round. It helps you negotiate from a position of strength and keeps equity dilution in check.

- Talent Acquisition: It’s what lets you offer competitive stock option packages. Without them, attracting and keeping top-tier talent—especially seasoned executives—is nearly impossible.

- Strategic Decisions: An accurate valuation gives you a benchmark. It helps you measure progress and make smarter decisions about potential mergers, acquisitions, and partnerships.

A compelling valuation isn't just about the numbers. It’s built on the perceived strength of your leadership team. An experienced executive team massively de-risks an investment for VCs, often justifying a higher valuation simply by proving they have the expertise to execute the vision.

An Overview of Common Startup Valuation Methods

Before calculating your startup's worth, you need to understand one truth: valuation isn't a one-size-fits-all game. A pre-revenue company can't be measured with the same yardstick as a business with years of steady cash flow. It’s all about context.

Getting a handle on the logic behind the most common valuation methods is your first step. This knowledge helps you pick the right tool for the job, whether you're having your first chat with an angel investor or gearing up for a Series A round.

Comparing Key Valuation Approaches

To simplify things, we can split most valuation methods into two buckets: quantitative and qualitative. Think of it as the difference between "the numbers" and "the story."

- Quantitative Methods: These are all about the data. Methods like Discounted Cash Flow (DCF) try to predict future earnings and work backward to figure out what they’re worth today. Another is Comparable Analysis, which is like real estate—you look at what similar companies have sold for to get a benchmark.

- Qualitative Methods: These are a founder's best friend in the early days. Methods like the Scorecard Valuation Method or the Risk-Factor Summation Method put a value on things you can't easily quantify, like the strength of your founding team, the size of your market, and what makes you unique.

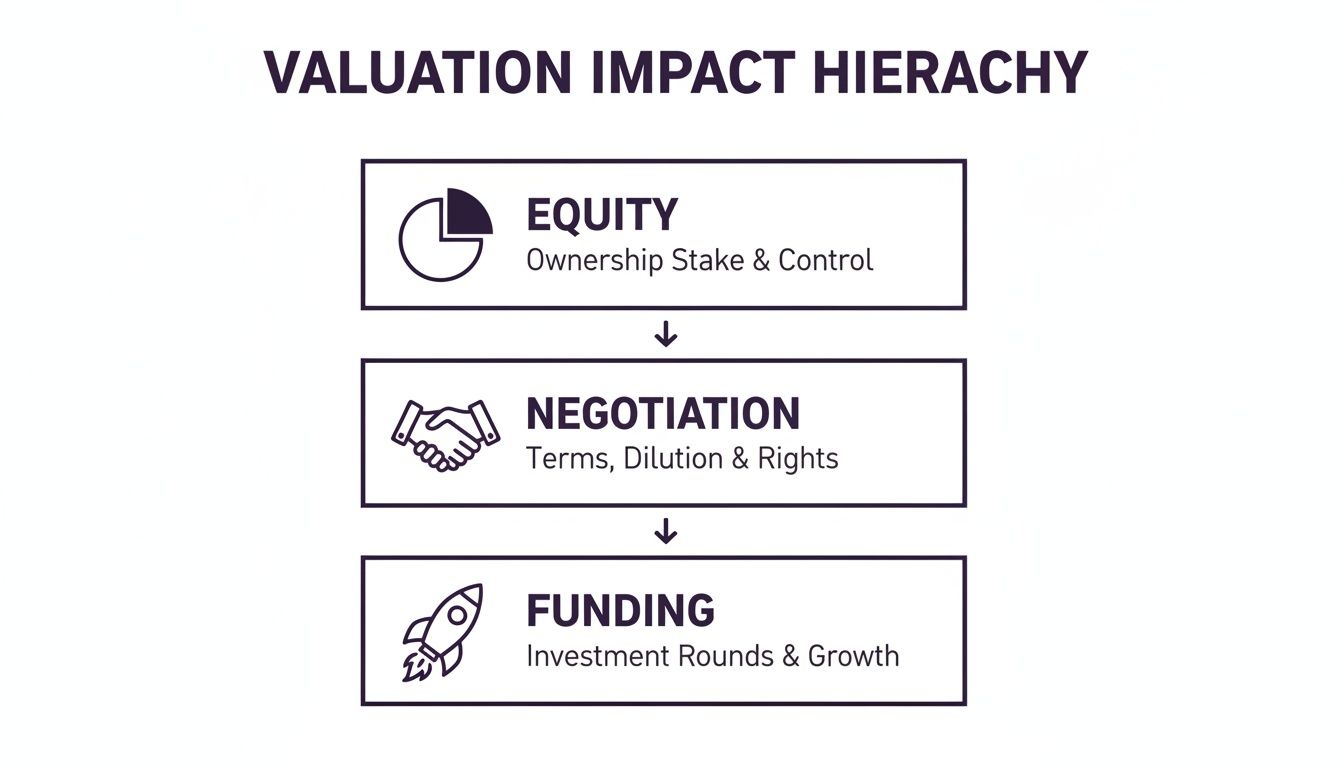

Ultimately, a solid valuation isn't just a number; it's the bedrock of your fundraising strategy. It directly influences how much equity you give up, how you negotiate, and how much funding you can realistically secure.

As you can see, getting your valuation right is the foundation for everything that follows in your funding journey.

Quick Guide to Startup Valuation Methods

To help you get a clearer picture, here’s a quick rundown of the most common methods, what they’re best for, and their complexity. This table can help you figure out which approach makes the most sense for your startup.

| Method | Best For | Primary Focus | Complexity |

|---|---|---|---|

| DCF | Mature startups with predictable revenue. | Future cash flow projections. | High |

| Comparables | Any stage with clear market competitors. | Market benchmarks and similar transactions. | Medium |

| Scorecard | Pre-seed/Seed startups with no revenue. | Team, market, product, and traction. | Low |

| Risk-Factor Summation | Early-stage companies facing many risks. | Identifying and quantifying key business risks. | Low |

| VC Method | Startups seeking venture capital funding. | Potential exit value and required ROI. | Medium |

Choosing the right method is about being honest about where you are. A founder with a more mature business might lean on DCF, while an early-stage founder will find the Scorecard or Risk-Factor methods more useful for telling their story.

Finding the Right Fit for Your Stage

The secret is to match the method to your company’s maturity. A DCF model is pure guesswork for a pre-revenue startup. But once you have predictable earnings, it becomes a powerful tool. On the flip side, qualitative methods are perfect for a pre-seed company but don’t carry much weight once real financial metrics are on the table.

This is why many founders don't just pick one. They use a blended approach, combining two or three methods to build a valuation range they can confidently defend.

A valuation is ultimately a story backed by numbers. Using a combination of methods helps you build a more convincing and resilient narrative for investors, demonstrating a thoughtful and comprehensive understanding of your company's worth.

Telling that financial story well often comes down to the quality of your projections. If you want to dive deeper into building those, our guide on startup financial modeling is a great place to start.

This is where a fractional CFO can be a game-changer. They don't just ensure your financial models are solid; their involvement adds a layer of credibility that investors notice. They help you pick the right valuation methods and, more importantly, defend them, turning your financial data into a compelling argument for your vision.

The Venture Capital Method: Thinking Like an Investor

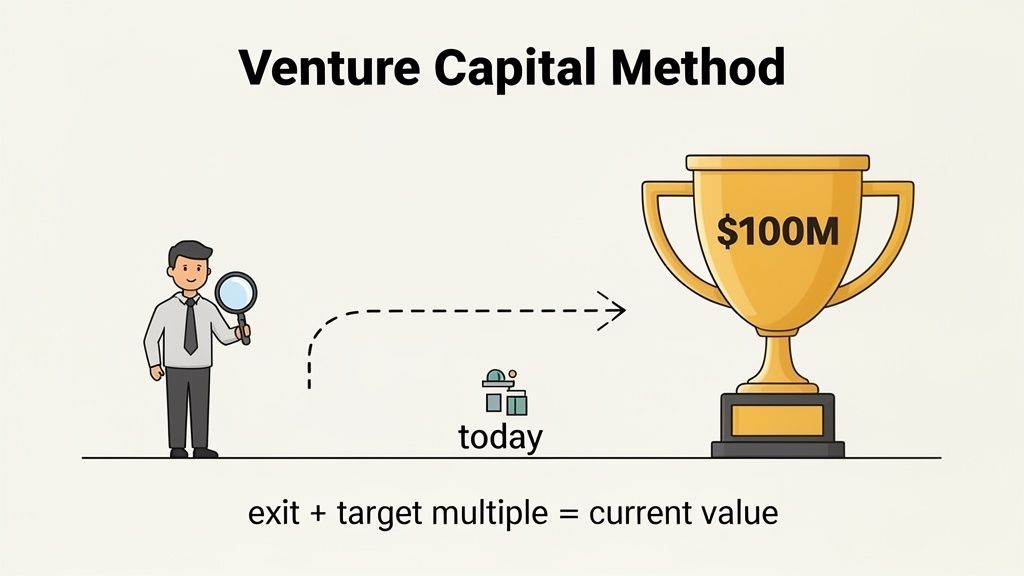

To get inside an investor’s head during a valuation discussion, you need to see the world from their perspective. The Venture Capital (VC) Method does exactly that. It starts with a future exit and works backward, zeroing in on one thing: the investor's required return on investment (ROI).

This approach is the bread and butter for valuing early-stage startups. Investors aren’t valuing what you have today; they're betting on what you can become. They’ll project a future exit—say, a $100 million acquisition in five years—and then apply a hefty discount rate to account for the risk.

This focus on ROI is why you often hear about a 10x return being the standard. If a VC invests at a $10M post-money valuation, they need to believe you can sell for $100M down the road to make the math work.

Calculating Valuation with the VC Method

The logic is refreshingly simple. It starts with the finish line and jogs back to the starting point to figure out today's value. It’s all about your potential to generate a massive return.

Let's walk through a quick example. Imagine a SaaS startup looking to raise $2 million.

- Project the Exit Value: The founder and investor agree the company could realistically be acquired for $80 million in seven years.

- Determine the Required ROI: The VC is targeting a 20x return. This number is high because early-stage ventures are incredibly risky.

- Calculate Post-Money Valuation: To get a 20x return on an $80M exit, the startup’s post-money valuation today must be $4 million ($80M Exit / 20x ROI).

- Calculate Pre-Money Valuation: Just subtract the investment from the post-money figure. In this case, that's $2 million ($4M Post-Money – $2M Investment).

This tells everyone that the company is valued at $2 million before the new cash comes in. A huge part of this is telling a story that makes that $80 million exit feel achievable. A great story starts with a great pitch deck, and our investor pitch deck template can help you build one that backs up your numbers.

Pros and Cons for Founders

Like any tool, the VC Method has its upsides and downsides. Knowing them ahead of time will help you navigate crucial investor conversations.

Key Takeaway: The VC Method forces founders to think critically about their long-term exit strategy and scalability from day one. It aligns your vision directly with the financial expectations of your potential partners.

Advantages:

- ROI-Focused: It speaks the language of venture capitalists by directly addressing their number one concern.

- Simplicity: The math is straightforward, boiling down to a few key assumptions you can debate.

- Future-Oriented: This method values your company based on its ultimate potential, not its limited, present-day performance.

Disadvantages:

- Highly Speculative: The entire model hangs on predicting a future exit value, which is basically an educated guess.

- Ignores Intangibles: It doesn't have a place for your killer team, bulletproof intellectual property, or market momentum.

- Investor-Biased: The method is driven by the investor's required return, which can feel disconnected from what a founder believes the company is intrinsically worth.

Valuing Potential with the Berkus and Scorecard Methods

When your startup is little more than a brilliant idea and a dedicated team, traditional valuation methods fall flat. How do you value a company with no revenue? This is where qualitative valuation methods come into play. They help you build a compelling narrative around your potential, not just your past performance.

Think of it like a scout evaluating a promising young athlete. They don't have professional stats, so they look at raw talent, drive, and potential. These methods turn your qualitative strengths—like your team's expertise or a key partnership—into a quantifiable number that investors can get behind. They provide a structured way to assess a pre-revenue company by focusing on the drivers of future success.

The Berkus Method Explained

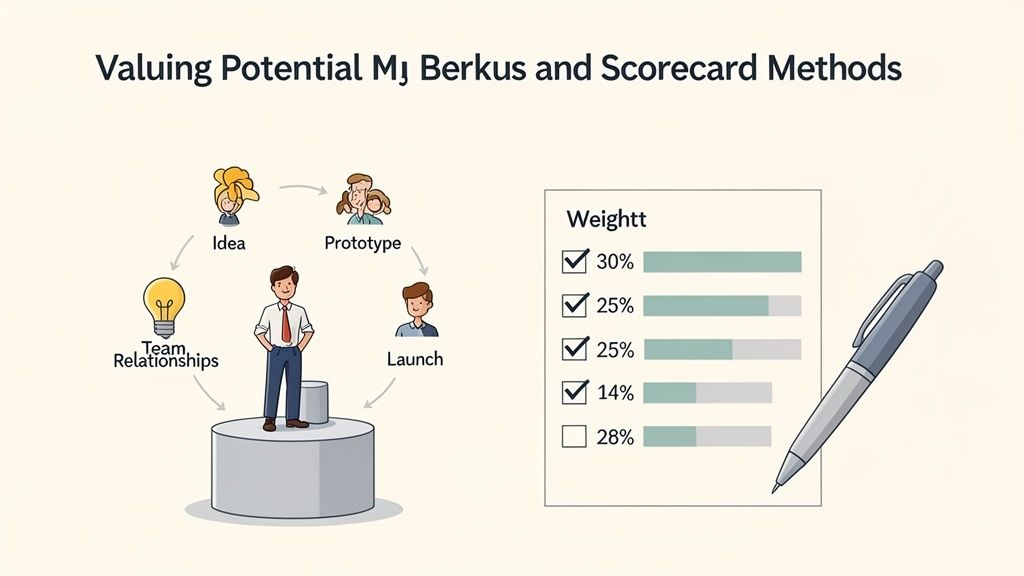

The Berkus Method is a brilliantly simple tool for pre-revenue startups. It works by assigning a monetary value to five key drivers critical for any early-stage venture.

Created by famed angel investor Dave Berkus, this method caps valuations at $2.5 million by assigning up to $500,000 for progress across five pillars: having a killer team, a hefty market opportunity, a game-changing prototype, strategic partnerships, and any initial sales traction.

The beauty of this approach is that it sidesteps shaky projections in favor of tangible milestones, making it ideal for founders in emerging fields. You can read more about this early-stage valuation approach on Acquire.com. It gives you a clear, defensible framework based on what you've actually accomplished.

Applying the Scorecard Valuation Method

The Scorecard Valuation Method takes things a step further by introducing a comparative angle. It starts by finding the average pre-money valuation for similar startups in your region and industry. From there, it adjusts that baseline number using a weighted scorecard.

Here’s a common breakdown of how those factors are weighted:

Notice how heavily this method weighs the management team? It's a clear reminder that early-stage investors bet on people first. Your startup gets compared to the "norm" on each factor and is assigned a score (e.g., 125% for an exceptionally strong team, or 75% for a smaller market).

The final valuation is calculated by multiplying that average valuation by the sum of your weighted scores.

For example, if the average pre-money valuation is $1.5 million and your total weighted score is 1.15 (115%), your valuation would be $1.725 million.

This method's real strength is grounding your valuation in market data while still making room for your unique advantages. It’s a structured way to argue why your team, your tech, and your vision deserve a premium.

These qualitative methods are powerful because they focus on the very elements that experienced fractional executives bring to the table: leadership, strategy, and market insight. A strong fractional leader can directly boost your score in that all-important "Strength of Management Team" category, justifying a higher valuation before you’ve generated a dollar of revenue.

How to Choose the Right Valuation Method

Picking the right valuation method is one of the most strategic decisions you'll make. It’s about crafting a believable narrative for investors. The "best" method is the one that tells the most credible story for your specific company, right now.

For example, a pre-revenue startup trying to use a Discounted Cash Flow (DCF) model will look like they're making things up. Smart founders lean on qualitative methods like the Scorecard or Berkus method to build a case around what they can prove: the strength of their team, a massive market opportunity, or a killer tech edge.

On the other hand, if your business has a few years of solid revenue, you should bring a DCF analysis to the table alongside market comparables. It adds a layer of financial rigor that investors expect.

Creating a Defensible Valuation Range

Here’s a pro tip: the savviest founders never hang their hat on a single number. Instead, they create a blended valuation by using two or three approaches to establish a defensible range.

This shows investors you've done your homework. For instance, you might use the Scorecard method to set a baseline, then layer on a Comparable Analysis to show how you stack up against recent deals. This triangulation gives you a much stronger footing in a negotiation.

The Impact of Strategic Leadership

This is where things get interesting. Your leadership team can completely change which valuation methods are believable. Bringing on an experienced fractional CFO, for example, adds immediate credibility to your financial projections.

With a seasoned financial expert guiding your strategy, a DCF analysis suddenly becomes far more convincing, even at an earlier stage. Their presence signals operational maturity and de-risks the investment, justifying a stronger valuation.

Take the Scorecard Valuation Method. The most important factor? The strength of the management team, which accounts for a massive 30% of the score. Market size (25%) and product (15%) follow behind.

This heavy emphasis on leadership is a perfect example of how hiring an experienced fractional executive can directly boost your valuation. You can get a deeper dive into how this popular method works on Equidam.com.

Ultimately, choosing the right method is about building a compelling story. Having the right executive talent on your team doesn't just improve operations—it makes that story a whole lot more believable.

Negotiating Your Valuation Beyond the Spreadsheet

After the number-crunching, remember a fundamental truth: a valuation isn't a fixed number. It’s the starting point of a conversation. A valuation is a story that both you and an investor agree to believe in. This is where you master the art of negotiation, justifying your number with a story that’s impossible to ignore.

A good story isn't just about lofty projections. It has to be grounded in tangible proof points that de-risk the investment in an investor's eyes. This means shining a spotlight on your traction, market validation, and unique strengths.

The Power of Leadership in Negotiations

This is where your leadership team becomes your greatest asset. Investors aren't just buying an idea; they're betting on the people who have to pull it off. Bringing a seasoned executive onto your team—even in a fractional capacity—sends an immediate signal of credibility and operational maturity.

An investor’s primary concern is mitigating risk. A team led by proven executives demonstrates a lower execution risk, directly strengthening your negotiating position and justifying a higher valuation.

A fractional executive brings a track record that speaks for itself. They’ve navigated the chaos of growth, solved problems you haven't seen yet, and built value before. Their presence on your cap table is a powerful endorsement of your company’s potential.

To solidify your position, be over-prepared. Have a clean data room ready for due diligence. Know the market comps from recent, similar deals. When an investor sees a rock-solid team backed by airtight data, your valuation becomes much harder to argue with.

Frequently Asked Questions About Startup Valuation

Diving into startup valuation can feel like learning a new language. There are a lot of terms, nuance, and room for confusion. Founders constantly wrestle with these questions, especially when gearing up for investor meetings. Let’s clear up some of the most common ones.

One of the biggest head-scratchers for founders is the difference between a 409A valuation and a fundraising valuation. Think of the 409A as a technical necessity—it’s done for tax compliance to set the fair market value for employee stock options. A fundraising valuation is the price investors agree to pay for preferred stock. It's almost always higher.

Key Valuation Questions Answered

Getting these details right helps you walk into investor conversations with more confidence. Here are a few questions we hear all the time:

- How soon should we get a valuation after a funding round? Immediately. A new funding round is a "material event," meaning your old valuation is instantly out of date. Getting a fresh one right away is crucial for issuing new, compliant stock options.

- Is a lower valuation always better for employees? Not really. The goal isn't to be low, it's to be accurate and defensible. An artificially low price could trigger IRS penalties for your team, undermining the point of giving them equity.

- What if my company is pre-revenue? This is where the "art" of valuation comes in. For pre-revenue startups, methods shift from hard financials to potential. Appraisers will look at the strength of your team, market size, IP, and how you stack up against similar early-stage companies.

A huge mistake is thinking one method will spit out the answer. A strong, defensible valuation is a story. You're building a narrative from multiple angles, blending your qualitative strengths with market data to tell investors why your future is so bright.

Having an experienced executive on your team—even a fractional one—can make that story infinitely more compelling. Their track record is proof they know how to build value, which de-risks the venture for investors and makes your arguments for a higher valuation much more believable.

Ready to build the leadership team that investors can't ignore? Shiny connects you with a network of over 3,000 vetted fractional executives who can provide the strategic guidance needed to impress investors and drive growth. Explore our network of vetted fractional executives and schedule a consultation to find the perfect partner to strengthen your valuation story. Find out more at https://useshiny.com.