What is a Fractional? Your Guide to Smart Ownership Stakes

What is a Fractional? Breaking Down Modern Ownership

Fractional ownership is a modern approach to acquiring high-value assets. It allows multiple individuals to share the costs and benefits of ownership, making luxury items and investments more accessible. Instead of one person shouldering the entire burden, the financial commitment is divided amongst co-owners. Think of it as purchasing a piece of the pie, rather than the whole dessert.

Understanding The Basics of Fractional Ownership

Fractional ownership distributes the costs and responsibilities associated with an asset. This includes maintenance, management fees, and any other related expenses. Sharing these costs makes owning high-value items more manageable.

For example, if five people co-own a vacation home, each individual is responsible for only 20% of the associated costs. This can be a game-changer for those who desire access to such assets but cannot afford the full price.

This model is especially appealing for infrequently used assets. Owning a private jet, for instance, is often financially out of reach for individuals. However, sharing the cost with a group can make private air travel a reality. It provides the perks of ownership without the hefty financial commitment. This concept also extends to specialized business services, like hiring a fractional CFO. Learn more about this here: How to master fractional CFO services.

The Growing Trend of Fractional Investments

Fractional real estate investing, in particular, has experienced significant growth globally. This trend is especially strong in North America, Europe, and Asia. This model allows investors to buy smaller shares of valuable properties, providing a more attainable entry point.

Several factors have contributed to this growth, including low interest rates and urbanization. Technological advancements have also played a key role, making transactions smoother and more transparent. Global Market Trends in Fractional Real Estate Investing offers further insights into this burgeoning market. Major global cities like New York, London, and Tokyo are leading this movement towards flexible investment options. This trend is especially beneficial for portfolio diversification and reducing initial capital outlay.

The Legal Framework of Fractional Ownership

Protecting investor rights is paramount in fractional ownership. Established legal frameworks define each co-owner’s rights and responsibilities, creating a transparent and secure investment environment.

These legal frameworks often detail usage rights, ownership percentages, and the process for transferring ownership. This structured approach provides clarity and security, fostering trust and confidence in the fractional market. This established framework makes transactions seamless and encourages broader adoption of this modern ownership model.

Fractional Real Estate: From Luxury Dreams to Reality

Fractional real estate has opened the doors to high-end properties for a wider range of investors. It provides a way to own a piece of luxury, sharing the costs and benefits among co-owners. This model makes luxury real estate more attainable than ever.

Exploring Different Fractional Real Estate Models

Several models exist within the fractional real estate landscape, each with its own distinct characteristics. Private residence clubs are a popular choice, offering luxurious accommodations in desirable locations. Usage is typically allocated based on the percentage of ownership.

Another model gaining traction is the fractional REIT (Real Estate Investment Trust). Fractional REITs allow investors to buy shares in a portfolio of properties, providing an opportunity for broader diversification.

Some platforms specialize in fractional ownership of individual high-value homes. This offers greater customization and a stronger emotional connection to a specific property. The variety of models allows investors to align their choices with their individual financial goals and preferences.

To compare these models, let’s take a look at the table below:

To provide further clarity on these different fractional real estate investment models, we’ve compiled a comparison table outlining their key features and differences. This will help you understand which model might be best suited for your investment goals.

Fractional Real Estate Models Comparison

This table compares different fractional real estate investment models across key factors like minimum investment, expected returns, liquidity, and management structure.

| Model Type | Typical Minimum Investment | Expected Annual Returns | Liquidity Level | Management Structure |

|---|---|---|---|---|

| Private Residence Club | $100,000+ | 5-8% | Moderate | Dedicated Management Company |

| Fractional REIT | $5,000+ | 4-6% | High | REIT Management Team |

| Individual High-Value Home | $50,000+ | 6-10% | Low to Moderate | Platform or Third-Party Manager |

The table above reveals some key distinctions. While private residence clubs typically require higher minimum investments, they offer a more exclusive experience. Fractional REITs provide enhanced liquidity and lower minimums, while individual home ownership falls somewhere in between.

Accessing Premium Properties: Case Studies and Entry Points

Fractional ownership has made premium properties more accessible than ever before. Investors are finding opportunities in sought-after locations with surprisingly manageable initial investments. Some fractional offerings start as low as $50,000, expanding the possibilities for a broader investor base.

Understanding Fractional Contracts and Market Growth

Understanding the nuances of fractional contracts is essential. Different contracting models, including options like fixed price contracting, are crucial to comprehend. These contracts often detail usage rights, maintenance responsibilities, and exit strategies.

The fractional interest market, particularly in the luxury private residential sector, has seen significant growth. Sales reached $624 million in 2022, up from $495 million in the previous year. This growth, primarily in the United States, Mexico, the Caribbean, and Canada, points toward a demand for flexible ownership structures.

Fractional Property Management: Practicalities and Exit Strategies

Professional management is a standard feature of fractional properties. This typically involves a management company handling maintenance and ensuring the property remains well-maintained. Pre-determined usage rights guarantee each owner their allotted access periods.

Understanding exit strategies is crucial. Options for selling your share may include reselling within the platform’s network or on the open market. The ease and speed of selling can vary based on the platform and the specific property. Careful consideration of this aspect is vital before investing.

Beyond Properties: The Expanding Fractional Universe

Fractional ownership isn’t just about real estate anymore. This model has diversified, offering investors exciting new opportunities across a broader range of assets. This section explores the fascinating world of alternative fractional investments and how they are democratizing access to luxury.

Luxury Items Redefined: Fractional Access to the Extraordinary

Savvy investors are now acquiring stakes in luxury items previously beyond their reach. Think private jets, yachts, rare art collections, and even vintage cars. Dedicated platforms are pioneering these models, making partial ownership of exclusive assets a reality.

Several companies, for instance, offer fractional ownership of private jets. This allows individuals to enjoy the perks of private air travel without bearing the full financial burden. Similarly, fractional yacht ownership opens up the world of luxury boating, minus the hefty maintenance and docking fees.

Fractional Business Ownership: A New Path to Entrepreneurship

The impact of fractional ownership extends beyond tangible assets into the business world. Fractional business ownership offers a unique pathway to entrepreneurship. Individuals can invest in and operate a portion of a business, sharing both the risks and the potential rewards. This can be particularly attractive for those looking to explore business ownership without a full commitment.

The concept of “fractional” also transcends traditional investment boundaries, finding applications even in scientific fields. For example, the volume fraction of carbon nanotubes in nanofluids influences their heat transfer properties. Studies show that small variations (0.003 to 0.051 vol%) can have significant effects. Learn more about CNT volume fraction in nanofluids. This demonstrates the wide-ranging applicability of the fractional concept.

Digital Assets and NFTs: The Future of Fractionalization?

Digital assets and NFTs (Non-Fungible Tokens) are pushing the boundaries of fractionalization. NFTs represent ownership of unique digital items like art, music, and collectibles. Fractionalizing these assets enhances accessibility and liquidity within the digital marketplace.

This means previously indivisible items can be broken down into smaller units of ownership, allowing a wider pool of investors to participate in assets once exclusive to a select few. This emerging trend is poised to reshape the future of ownership, with exciting new applications on the horizon.

The Reality Check: Benefits and Risks You Should Know

Fractional ownership is an intriguing investment strategy. However, it’s essential to understand both the advantages and disadvantages before diving in. A balanced perspective is crucial to determine if this investment model aligns with your financial goals. This section explores the realities of fractional ownership, offering a clear view of its potential and its drawbacks.

The Upsides: Advantages of Fractional Ownership

Fractional ownership offers several compelling benefits. Perhaps the most attractive is the lower barrier to entry. This democratizes access, allowing a wider range of investors to participate in assets traditionally reserved for high-net-worth individuals. Fractional ownership unlocks opportunities that were previously unattainable for many.

Diversification is another key advantage. By allocating smaller amounts across multiple fractional assets, you can reduce your overall investment risk compared to concentrating capital in a single holding. This strategy spreads your investment, potentially mitigating losses in one area with gains in another.

Finally, fractional ownership often simplifies the investment process. Reduced management responsibilities are a common feature. Professional management companies typically handle the day-to-day operations, freeing up your time and energy. You can enjoy the benefits of ownership without the burden of daily management.

The Downsides: Risks to Consider

While fractional ownership offers many positives, there are also risks to consider. One primary concern is limited control. Decisions regarding the asset are shared among multiple owners, potentially leading to compromises or disagreements that don’t align with your individual preferences.

Liquidity can also present a challenge. Selling a fractional share might require time and effort, especially for niche or less common assets. This could potentially tie up your capital longer than anticipated, impacting your overall investment strategy.

Furthermore, navigating co-ownership relationships can be complex. Disagreements among owners can and do arise, adding another layer of complexity to the investment. Clear communication and a shared understanding of the ownership agreement are vital for success. For further insights on managing shared roles, check out this resource: How to master fractional C-suite roles.

The Financial Reality: Fees and Taxes

Beyond the initial investment, it’s important to understand the ongoing costs associated with fractional ownership. Platforms typically charge management fees, which directly impact your overall returns. These fees can vary significantly, so careful comparison across different platforms is crucial.

Tax implications are another important factor. The tax treatment of fractional ownership can be complex, depending on the specific asset and your jurisdiction. Consulting with a qualified tax professional is highly recommended to ensure compliance and optimize your tax strategy.

Weighing the Scales: Making Informed Decisions

To help you evaluate this investment strategy, we’ve compiled the following table:

Fractional Ownership: Pros and Cons Analysis

This table outlines the key advantages and disadvantages of fractional ownership, considering financial, management, and liquidity factors.

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Financial | Lower entry point, diversification potential | Ongoing fees, complex tax implications |

| Management | Reduced responsibilities, professional management | Limited control over asset decisions |

| Liquidity | Access to high-value assets | Potential challenges in selling fractional share |

| Ownership | Shared costs and benefits | Potential for disagreements among co-owners |

By carefully weighing the benefits and risks outlined above and in the table, you can make a well-informed decision. Consider these factors in light of your personal financial situation and investment goals to determine if fractional ownership is the right strategy for you.

Global Fractional Trends: Where the Market Is Heading

The fractional ownership landscape is constantly evolving, with new trends appearing worldwide. This section explores key markets embracing fractional models, growing asset categories, and the evolving regulatory and technological influences shaping the future of fractional ownership.

Regional Adoption: A Look at Emerging Markets

Fractional ownership adoption varies globally. Some regions quickly adopt these models due to economic growth, regulatory updates, and increasing demand for accessible investments. Others face challenges like regulatory uncertainty or cultural resistance to shared ownership. Understanding these regional differences is key to identifying promising investment opportunities.

For example, fractional ownership in India is booming, fueled by both regulatory changes and market demand. The Securities and Exchange Board of India (SEBI) introduced guidelines for Small and Medium REITs (SM REITs), aiming to bring over INR 40 billion of unregistered real estate assets into the regulated market. This increased transparency and security is expected to attract more investment.

The Indian office market, in particular, has seen significant growth in fractional ownership, with strata sales comprising 28% of Grade A stock in major cities. The market value of this strata office stock is projected to hit INR 4,500 billion by 2026. This growth showcases the potential of fractional ownership to democratize real estate investment.

Asset Categories: Where the Growth Is Happening

Real estate remains a dominant force in fractional ownership, but other asset classes are also experiencing impressive growth. Demand for fractional ownership of luxury goods like private jets and yachts is rising, driven by the desire for shared access to high-value assets. Fractional business ownership is also emerging, offering a new path to entrepreneurship. This allows individuals to invest in and operate a portion of a business without full responsibility.

The Regulatory Landscape: Navigating Legal Frameworks

Regulatory environments significantly impact the development and adoption of fractional ownership. Jurisdictions with clear, supportive regulations tend to attract more investment and encourage innovation. Conversely, areas with unclear or restrictive legal frameworks can hinder growth and create investor uncertainty. As fractional ownership expands, monitoring the adaptation and evolution of regulatory landscapes is vital.

Technology’s Impact: Blockchain and Digital Platforms

Technology is reshaping fractional markets. Blockchain technology, with its inherent transparency and security, provides a strong framework for managing fractional ownership transactions. Digital platforms are simplifying the investment process, making it easier to discover, evaluate, and invest in fractional assets. These technological advances improve efficiency while boosting trust and accessibility within the fractional market. For more on how work structures are changing, check out: The Great Resignation and Fractional Work. These technological advancements will continue to shape the future of fractional ownership.

Your Fractional Journey: From Curious to Confident

This section offers a practical guide to entering the fractional market. We’ll walk you through self-assessment, platform evaluation, the investment process, opportunity analysis, and exit strategies. This journey will empower you with the knowledge and confidence needed to navigate the world of fractional ownership.

Assessing Your Readiness For Fractional Investing

Before exploring fractional investments, it’s important to assess your financial standing and investment objectives. Begin with an honest evaluation of your risk tolerance. Are you comfortable with potential ups and downs in asset value?

Next, define your investment timeframe. Are you seeking short-term gains or long-term growth? Finally, determine your budget. How much capital are you prepared to allocate to fractional investments?

Evaluating Fractional Platforms: Beyond The Marketing

Selecting the right platform is crucial. Don’t be fooled by flashy marketing. Focus on asking key questions. What are the platform’s fees? How transparent is their communication? What’s their track record?

Watch for red flags like unclear fee structures, poor communication, or past disputes.

Navigating The Investment Process: A Step-by-Step Guide

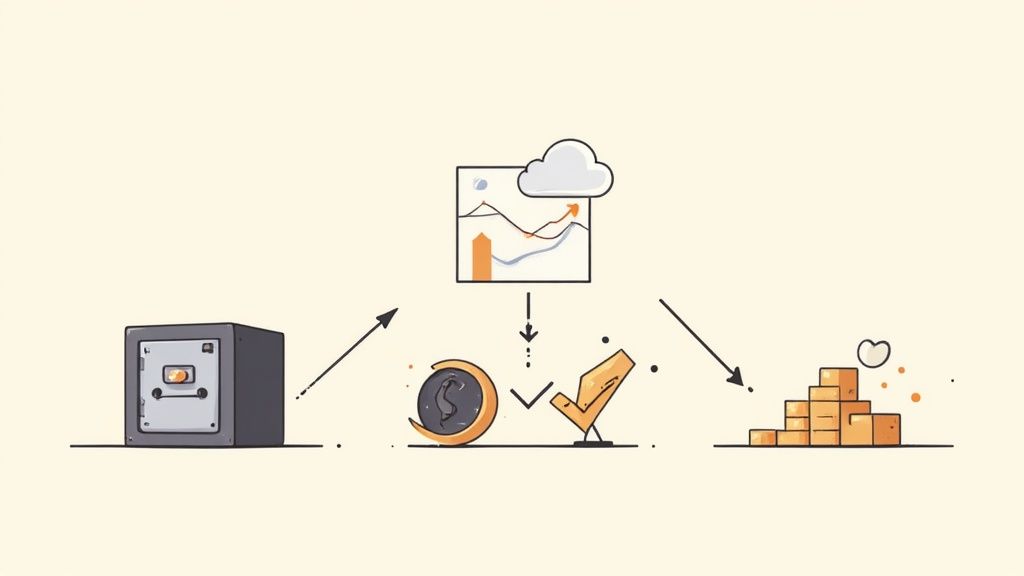

After choosing a platform, the investment process generally involves these key steps:

- Research: Investigate available opportunities, considering factors like asset type, location, and projected returns.

- Due Diligence: Verify provided information, reviewing the asset’s financials and legal documents.

- Negotiation: Discuss the terms of the investment, such as your ownership percentage and usage rights.

- Closing: Finalize the legal paperwork and transfer funds.

Throughout this process, ensure you understand the documentation and legal protections provided. A clear contract detailing your rights and responsibilities is vital.

Evaluating Opportunities: Calculating True Costs and Returns

Promotional materials often highlight potential returns. It’s essential to calculate the true costs, encompassing management fees, maintenance expenses, and other related costs.

Realistically assess potential returns, factoring in market conditions and historical data.

Learning From Experience: Case Studies and Pitfalls

Real-world examples provide valuable insights. Analyze both successful and unsuccessful fractional investments to grasp common pitfalls. For instance, disagreements among co-owners can emerge, emphasizing the need for clear communication and a comprehensive ownership agreement.

Managing And Exiting Your Fractional Investments

Monitoring your fractional assets is essential. Regularly review performance reports and stay informed about any developments that could impact their value.

Develop a sound exit strategy. Decide when and how you intend to sell your fractional share, considering market conditions and your personal financial goals.

Investing in fractional executives can be another excellent use of the fractional concept, particularly for startups. Shiny offers a marketplace connecting startups with seasoned executives for part-time roles. This can be a budget-friendly approach to access high-level talent. Learn more about fractional executives and how they can help your startup grow.