When to Hire a CFO: An Essential Guide for Growing Businesses

Deciding when to hire a CFO isn't about hitting a magic revenue number. It’s about recognizing when your financial complexity starts to outrun your current team's capacity. The real trigger is often when you're preparing for a big funding round, managing explosive growth, or when the CEO is sinking more than 20% of their time into financial puzzles instead of leading the company.

Is Your Business Flying Blind Financially?

Think of your early-stage business as a small, single-engine plane. As the founder, you can handle the controls, keep an eye on the gauges, and land it yourself. It's manageable.

But as your ambitions grow, your business becomes a commercial jetliner. Suddenly, the complexity is off the charts. You're dealing with advanced systems, multiple engines, and flight plans that span continents.

Trying to fly that jetliner alone isn't just a challenge—it's dangerous. You need an expert co-pilot managing systems, talking to air traffic control, and helping you navigate. Your growing business is that jetliner. A Chief Financial Officer is your indispensable co-pilot.

Moving Beyond Simple Bookkeeping

In the early days, a bookkeeper or accountant gets the job done. They are historians, looking backward to record transactions and ensure your taxes are filed correctly. Their role is to tell you where your money has been. It’s essential scorekeeping, but it won’t help you see around the corner.

A CFO, in contrast, is your forward-looking strategist. They use historical data to build sophisticated financial models, forecast performance, and chart a course toward your long-term vision. They’re less concerned with where you've been and intensely focused on where you're going.

A classic mistake is waiting for a financial crisis before hiring a CFO. At that point, you're already flying through turbulence. The smart move is to bring your co-pilot on board before you hit the storm, giving them time to spot challenges ahead and guide you toward clear skies.

This guide will help you identify the real operational triggers that signal it's time for high-level financial leadership. We'll also explore how flexible solutions, like fractional leadership, can give you that top-tier expertise right when you need it, without the full-time price tag.

Quick Guide to Financial Leadership Needs

This table simplifies the journey, showing how financial responsibilities evolve as your company grows.

| Business Stage | Primary Financial Need | Typical Role |

|---|---|---|

| Startup / Seed | Transaction Recording & Compliance | Bookkeeper / Accountant |

| Growth / Series A | Cash Flow Management & Basic Forecasting | Controller / Fractional CFO |

| Scaling / Series B+ | Strategic Planning & Fundraising | Full-Time or Fractional CFO |

| Mature / Enterprise | Risk Management & M&A Strategy | Full-Time CFO & Finance Team |

As you can see, the needs shift from historical record-keeping to forward-looking strategy. Recognizing your stage is the first step to getting the right financial expertise.

Understanding the Strategic CFO Role

Before you can know when to hire a CFO, you need to grasp what a strategic CFO actually does. Many founders mistakenly view the role as a senior accountant, but their jobs are fundamentally different.

Think of it this way:

- Your accountant is a business historian, meticulously recording past events.

- Your controller is the manager of the present, overseeing daily operations and closing the books.

- Your CFO is the architect of your company’s financial future, drawing the map that gets you where you want to go.

More Than Just a Numbers Expert

A modern CFO operates far beyond spreadsheets. They are a strategic partner who translates financial data into a competitive advantage, focusing on moves that build sustainable growth.

Here’s what that looks like in practice:

- Capital Strategy: Securing the right type of funding—be it debt or equity—at the right time and on the best possible terms.

- Operational Excellence: Diving into your unit economics, challenging pricing models, and scrutinizing budgets to improve efficiency and profit.

- Risk Management: Spotting financial icebergs long before they appear on the horizon and developing plans to steer the company clear of trouble.

- Investor Relations: Acting as your company’s financial storyteller, communicating your progress and vision to the board, investors, and banks with credibility.

The most impactful CFOs don't just report the numbers; they shape them. They transform finance from a reactive cost center into a proactive engine for growth.

The Evolving Demands on Financial Leaders

The CFO role is becoming more complex. Today, 95% of North American CFOs manage everything from operational oversight to AI strategy and fundraising.

Delaying this hire risks a messy cap table, a botched funding round, or a sudden cash crunch—mistakes that can sink a promising company. This is why many startups now start with a fractional CFO, getting access to a vetted professional for 5-25 hours a week and scaling from there. Learn more about the evolving CFO role.

Ultimately, hiring a CFO is an investment in strategic foresight. It’s about bringing in a co-pilot to see through the financial fog and help you steer the ship with precision.

Seven Key Triggers That Signal It Is Time for a CFO

The right moment to hire a CFO isn’t about revenue; it’s about complexity. Certain inflection points signal that a forward-looking financial leader is no longer a luxury but a necessity for survival and growth.

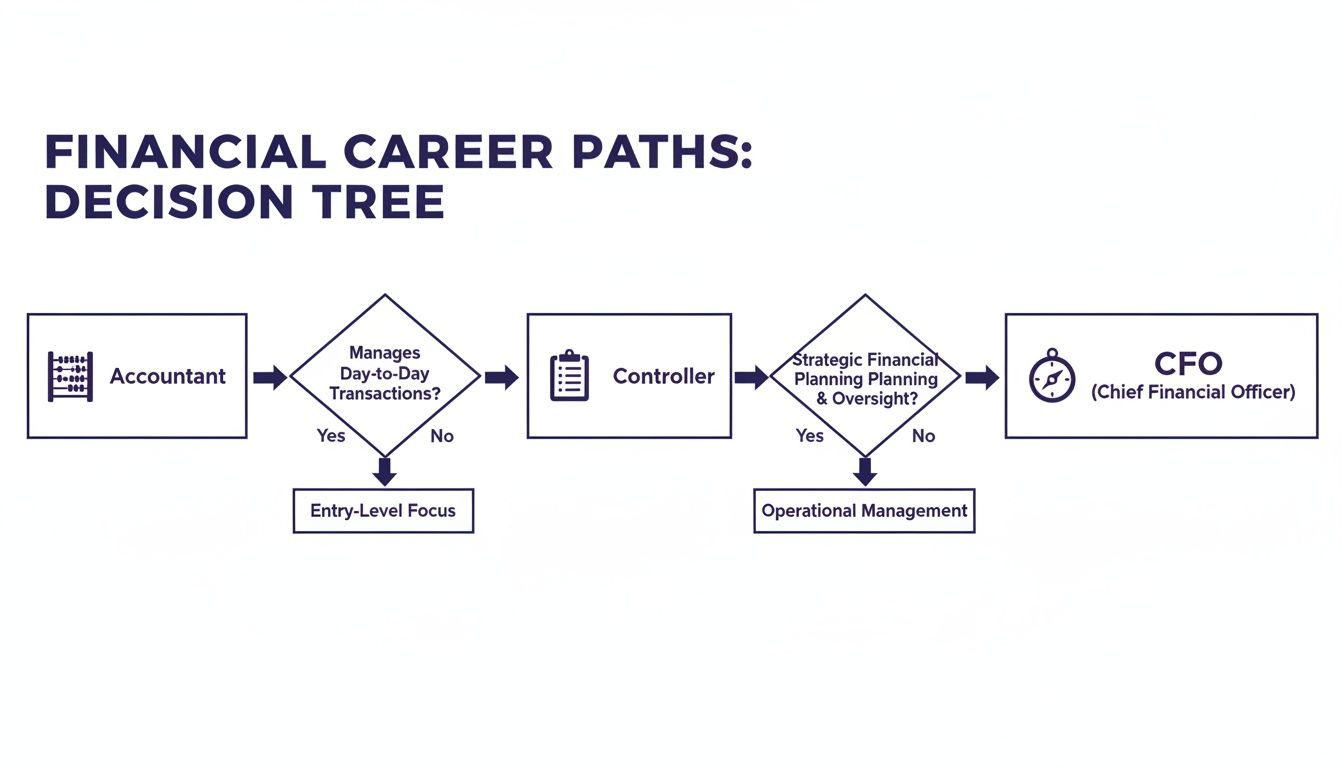

This visual shows the natural progression in finance as a company scales, from basic bookkeeping to high-level strategic planning.

As you can see, the finance function matures from a historical scorekeeper (Accountant) to a present-day manager (Controller), and finally to a future-focused strategist (CFO).

1. Planning a Significant Funding Round

If you’re gearing up for a Series A or another major funding round, investors need more than a good story. They expect a sophisticated financial model, a clear grasp of your unit economics, and a strategic roadmap for how you'll use their capital. An experienced CFO translates your vision into a compelling financial narrative that builds investor confidence.

2. Managing Rapid, Unpredictable Growth

Hyper-growth is thrilling but dangerous. As revenue skyrockets, so do expenses and operational chaos. Without strategic financial oversight, it's easy to outgrow your cash runway. A CFO implements the forecasting and control systems needed to manage that growth sustainably.

3. Navigating Intricate Cash Flow Challenges

As you grow, cash flow becomes more complex. You might have subscription models with deferred revenue, long enterprise sales cycles, or major capital expenditures that create cash gaps, even when you're profitable on paper. If you’re constantly wrestling with receivables and payables, you need expert oversight. Our guide on how to manage cash flow offers deeper insights.

When the CEO is spending more than 20% of their time on financial management, they are no longer leading the company—they are serving as an under-qualified, over-paid financial analyst. This is one of the most urgent triggers for bringing in an expert.

4. Preparing for an M&A or Exit Strategy

Thinking about a merger, acquisition, or future exit? These events demand incredible financial diligence. Your books must be pristine, your valuations rock-solid, and your financial reporting investor-grade. A CFO orchestrates this entire process, ensuring you maximize company value.

5. Expanding into New Markets or Products

Launching a new product or entering an international market introduces new financial variables: different pricing strategies, currency risks, and unfamiliar tax laws. A CFO analyzes the financial viability of these moves, models the potential ROI, and builds the infrastructure to support the expansion.

6. Facing Heightened Regulatory Burdens

As you get bigger, you face new compliance headaches, like industry-specific regulations, complex sales tax rules, or stringent ASC 606 revenue recognition standards. A CFO ensures you stay ahead of these requirements, minimizing risk and helping you avoid costly penalties.

7. The CEO Becomes the De Facto CFO

If you, the founder or CEO, are building financial forecasts, managing banking relationships, and wrestling with budget approvals, your focus is dangerously split. Your time is most valuable when spent on vision, culture, and product. When you've become the de facto CFO, it's a critical sign that you need a dedicated financial partner.

The Hidden Costs of Delaying Your CFO Hire

Knowing you need a CFO is one thing; hiring one is another. Many founders believe they can stretch their current setup a little longer. But this delay has steep, often invisible costs that can silently cripple a promising company.

For example, a startup with booming sales might not see that its customer acquisition cost is spiraling out of control. Suddenly, despite record revenue, they face a severe cash crunch and are forced to take on high-interest debt to make payroll. This is a classic symptom of a company flying without a financial strategist.

Opportunities Lost and Mistakes Made

Waiting too long often leads to huge, avoidable strategic blunders. These mistakes are far more expensive than a CFO’s salary.

Here are a few common scenarios:

- Fumbled Funding Rounds: A startup presents a simplistic spreadsheet model to investors, who immediately poke holes in their assumptions. Confidence evaporates, leading to a lower valuation or a lost deal.

- Missed Acquisition Offers: A competitor expresses interest, but the company's financials are a mess. Their inability to produce clean, investor-ready data during due diligence kills the deal, leaving millions on the table.

- Inefficient Capital Allocation: Lacking sophisticated analysis, a company pumps cash into a marketing channel with terrible ROI or over-hires in a non-essential department, burning through precious capital with little to show for it.

Delaying a CFO hire is like trying to build a skyscraper on a weak foundation. The structure might go up, but it’s only a matter of time before serious cracks begin to show.

Hiring a CFO isn’t a cost; it’s an investment in prevention. It provides the strategic foresight to turn potential disasters into massive growth opportunities.

Choosing Your Model: Full-Time vs. Fractional CFO

So, you see the signs and know it's time for serious financial leadership. The next question is: how do you bring that expertise on board without torpedoing your budget? For most growing companies, a full-time executive with a six-figure salary, benefits, and equity package feels out of reach.

This is where the fractional model changes the game. It’s a flexible, powerful, and cost-effective way to get the same C-suite talent, but only for the hours you actually need.

Understanding the Fractional CFO Advantage

Imagine you're building a house and hire a world-class architect. You don't pay them to be on-site every day mixing cement. You bring them in for their high-level expertise: to design the blueprints, solve complex structural problems, and oversee critical construction phases.

A fractional CFO works the same way. They focus their time on your most pressing strategic needs—like building your investor financial model or extending your cash runway—without getting bogged down in day-to-day administrative tasks. This approach delivers maximum impact with maximum efficiency. For a deeper dive, our guide explains the fractional CFO meaning in more detail.

The True Cost of a Full-Time Hire

A full-time CFO commitment includes more than just salary. For a Series B company, equity grants can reach up to 1.5%. On a $100M valuation, that stake is worth over $280,000 over a four-year vesting period, on top of salary and benefits.

Furthermore, the modern CFO role has expanded so much that 83% of finance leaders report increased pressure, contributing to a record-high global turnover rate of 15.1%.

The fractional model fundamentally de-risks executive hiring. It allows you to access top-tier talent with specialized skills for your immediate challenges, without the long-term financial burden.

To make the choice clear, let's compare the two models.

Full-Time CFO vs. Fractional CFO: A Comparison

This table breaks down the key differences to help you decide which model aligns with your business needs and budget.

| Factor | Full-Time CFO | Fractional CFO |

|---|---|---|

| Cost | High fixed salary, benefits, bonus, and equity | Variable cost based on hours; typically a fraction of a full-time salary |

| Commitment | Long-term employment contract | Flexible engagement; scales up or down as needed |

| Scope of Work | Blends strategic oversight with daily management | Focused on high-impact strategic projects and advisory |

| Onboarding | Lengthy recruitment and integration process | Rapid onboarding, often in a matter of days |

| Expertise | Deep knowledge of one company's operations | Broad expertise from working across multiple industries and challenges |

For any business at a critical growth point, the fractional model offers an intelligent path to securing world-class financial leadership, empowering you to make smarter decisions and accelerate growth.

Ready to Find Your Strategic Financial Partner?

You now understand the triggers, the strategic value of a financial partner, and the flexible options available. Making this move is a sign that your business is maturing and you're serious about building something that lasts. If you found yourself nodding along to the challenges we’ve discussed, it might be time for the next step.

This is especially true for companies in the $1M-$50M revenue range. You're past the initial scramble but not yet at IPO scale. CEOs in this phase need a finance leader who can also think like a COO—someone who can manage growth and map out strategy. This need is fueling a massive shift towards executive outsourcing, a market expected to hit $76 billion by 2033. You can find more insights on these CFO hiring trends here.

Connecting With the Right Expertise

Exploring how a fractional executive can provide the exact support you need is a logical first move. Instead of getting lost in recruiting, partnering with a curated network takes the guesswork out of the equation. You get connected with vetted leaders who have the specific industry experience to help you succeed.

The right financial partner doesn't just manage your books; they become a strategic pillar for your executive team, providing the data-driven confidence needed to make bold decisions.

Curious how a world-class fractional CFO can make a difference? Many excellent fractional CFO companies specialize in these connections. The trick is finding the one that aligns with your company’s growth stage and industry.

Your Next Stage of Growth

We connect companies with leaders from our talent pool who are ready to guide you through your next challenge—whether it's preparing for a funding round, getting cash flow under control, or scaling operations. If you're ready to find your financial co-pilot, we invite you to explore our services and see how the right leadership can unlock your company's full potential.

Got Questions? We've Got Answers

Here are straightforward answers to the questions we hear most often from founders and CEOs.

What’s the Real Difference Between a CFO and a VP of Finance?

While both roles are crucial, they operate at different altitudes.

- A VP of Finance manages the financial engine room. They focus on execution—managing accounting teams, nailing down reporting, and ensuring the financial strategy runs smoothly.

- A CFO is on the bridge with the captain, charting the course. They own the financial strategy, drive fundraising, and provide high-level insights that shape the company's future.

Is There a Magic Revenue Number for Hiring My First CFO?

No. It’s all about complexity, not just revenue. Most founders start to feel the pain between $3M and $10M in ARR. This is when forecasts become complex, you're seeking institutional funding, or operations are scaling rapidly. A business with a complex model at $3M might need a CFO sooner than a simpler business at $5M. The key is to watch for the business triggers.

Can a Fractional CFO Really Deliver the Same Punch as a Full-Timer?

Absolutely. Impact is about applying the right expertise at the right time. A great fractional CFO focuses exclusively on your biggest strategic headaches, like building an investor-ready financial model or optimizing your cash runway.

A fractional executive isn't bogged down in the day-to-day grind. This frees them up to apply top-tier C-suite brainpower to your most critical, high-impact challenges—all without the full-time price tag.

By zeroing in on strategic outcomes, a fractional leader can drive huge results in just a handful of hours each week.

Ready to see how a world-class fractional CFO could change the game for your business? We can connect you with vetted leaders from our extensive talent pool who are ready to help you navigate your next stage of growth. Schedule a consultation to find your strategic partner.